Quarterly City Sales Tax Report Form - City Of Port Alexander

ADVERTISEMENT

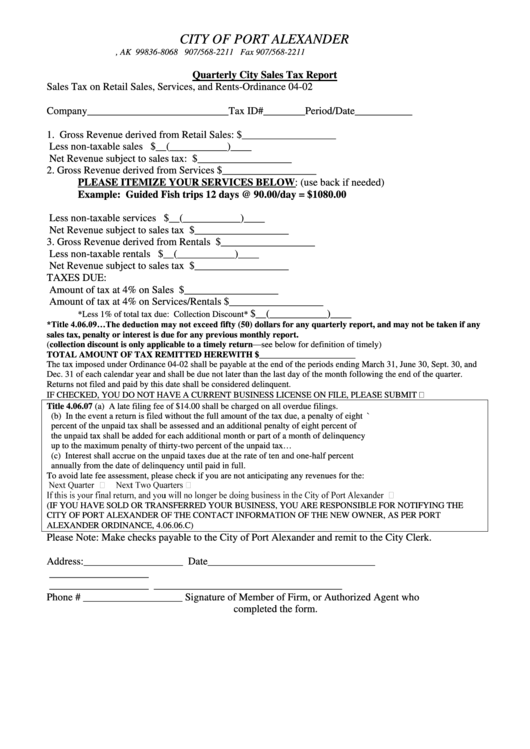

CITY OF PORT ALEXANDER

P.O. Box 8068 Port Alexander, AK 99836-8068 907/568-2211 Fax 907/568-2211

Quarterly City Sales Tax Report

Sales Tax on Retail Sales, Services, and Rents-Ordinance 04-02

Company___________________________Tax ID#________Period/Date___________

1.

Gross Revenue derived from Retail Sales:

$__________________

Less non-taxable sales

$__(___________)____

Net Revenue subject to sales tax:

$__________________

2.

Gross Revenue derived from Services

$__________________

PLEASE ITEMIZE YOUR SERVICES BELOW: (use back if needed)

Example: Guided Fish trips 12 days @ 90.00/day = $1080.00

Less non-taxable services

$__(___________)____

Net Revenue subject to sales tax

$__________________

3.

Gross Revenue derived from Rentals

$__________________

Less non-taxable rentals

$__(___________)____

Net Revenue subject to sales tax

$__________________

TAXES DUE:

Amount of tax at 4% on Sales

$__________________

Amount of tax at 4% on Services/Rentals

$__________________

$__(___________)____

*Less 1% of total tax due: Collection Discount*

*Title 4.06.09…The deduction may not exceed fifty (50) dollars for any quarterly report, and may not be taken if any

sales tax, penalty or interest is due for any previous monthly report.

(collection discount is only applicable to a timely return—see below for definition of timely)

TOTAL AMOUNT OF TAX REMITTED HEREWITH

$______________________

The tax imposed under Ordinance 04-02 shall be payable at the end of the periods ending March 31, June 30, Sept. 30, and

Dec. 31 of each calendar year and shall be due not later than the last day of the month following the end of the quarter.

Returns not filed and paid by this date shall be considered delinquent.

IF CHECKED, YOU DO NOT HAVE A CURRENT BUSINESS LICENSE ON FILE, PLEASE SUBMIT

Title 4.06.07

(a) A late filing fee of $14.00 shall be charged on all overdue filings.

(b) In the event a return is filed without the full amount of the tax due, a penalty of eight `

percent of the unpaid tax shall be assessed and an additional penalty of eight percent of

the unpaid tax shall be added for each additional month or part of a month of delinquency

up to the maximum penalty of thirty-two percent of the unpaid tax…

(c) Interest shall accrue on the unpaid taxes due at the rate of ten and one-half percent

annually from the date of delinquency until paid in full.

To avoid late fee assessment, please check if you are not anticipating any revenues for the:

(IF YOU HAVE SOLD OR TRANSFERRED YOUR BUSINESS, YOU ARE RESPONSIBLE FOR NOTIFYING THE

CITY OF PORT ALEXANDER OF THE CONTACT INFORMATION OF THE NEW OWNER, AS PER PORT

ALEXANDER ORDINANCE, 4.06.06.C)

Please Note: Make checks payable to the City of Port Alexander and remit to the City Clerk.

Address:___________________

Date________________________________

___________________

___________________

____________________________________

Phone # ___________________

Signature of Member of Firm, or Authorized Agent who

completed the form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1