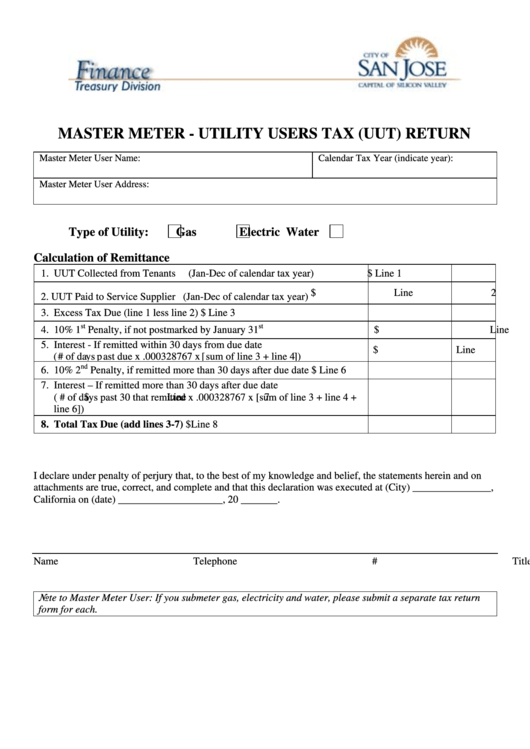

Master Meter - Utility Users Tax (Uut) Return Form - City Of San Jose - Finance Treasury Division

ADVERTISEMENT

MASTER METER - UTILITY USERS TAX (UUT) RETURN

Master Meter User Name:

Calendar Tax Year (indicate year):

Master Meter User Address:

Type of Utility:

Gas

Electric

Water

Calculation of Remittance

1. UUT Collected from Tenants

(Jan-Dec of calendar tax year)

$

Line 1

$

Line 2

2. UUT Paid to Service Supplier (Jan-Dec of calendar tax year)

3. Excess Tax Due (line 1 less line 2)

$

Line 3

st

st

4. 10% 1

Penalty, if not postmarked by January 31

$

Line 4

5. Interest - If remitted within 30 days from due date

$

Line 5

(# of days past due x .000328767 x [sum of line 3 + line 4])

nd

6. 10% 2

Penalty, if remitted more than 30 days after due date

$

Line 6

7. Interest – If remitted more than 30 days after due date

( # of days past 30 that remitted x .000328767 x [sum of line 3 + line 4 +

$

Line 7

line 6])

8. Total Tax Due (add lines 3-7)

$

Line 8

I declare under penalty of perjury that, to the best of my knowledge and belief, the statements herein and on

attachments are true, correct, and complete and that this declaration was executed at (City) _______________,

California on (date) ____________________, 20 _______.

Name

Telephone #

Title

Date

Note to Master Meter User: If you submeter gas, electricity and water, please submit a separate tax return

form for each.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2