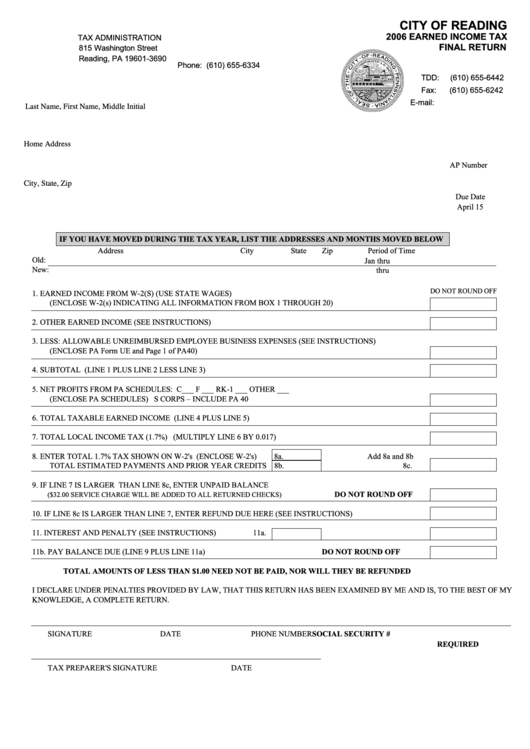

CITY OF READING

2006 EARNED INCOME TAX

TAX ADMINISTRATION

FINAL RETURN

815 Washington Street

Reading, PA 19601-3690

Phone: (610) 655-6334

TDD:

(610) 655-6442

Fax:

(610) 655-6242

E-mail:

Last Name, First Name, Middle Initial

Home Address

AP Number

City, State, Zip

Due Date

April 15

IF YOU HAVE MOVED DURING THE TAX YEAR, LIST THE ADDRESSES AND MONTHS MOVED BELOW

Address

City

State

Zip

Period of Time

Old:

Jan thru

New:

thru

DO NOT ROUND OFF

1. EARNED INCOME FROM W-2(S) (USE STATE WAGES)

(ENCLOSE W-2(s) INDICATING ALL INFORMATION FROM BOX 1 THROUGH 20)

2. OTHER EARNED INCOME (SEE INSTRUCTIONS)

3. LESS: ALLOWABLE UNREIMBURSED EMPLOYEE BUSINESS EXPENSES (SEE INSTRUCTIONS)

(ENCLOSE PA Form UE and Page 1 of PA40)

4. SUBTOTAL (LINE 1 PLUS LINE 2 LESS LINE 3)

5. NET PROFITS FROM PA SCHEDULES: C___ F ___ RK-1 ___ OTHER ___

(ENCLOSE PA SCHEDULES) S CORPS – INCLUDE PA 40

6. TOTAL TAXABLE EARNED INCOME (LINE 4 PLUS LINE 5)

7. TOTAL LOCAL INCOME TAX (1.7%) (MULTIPLY LINE 6 BY 0.017)

8. ENTER TOTAL 1.7% TAX SHOWN ON W-2's (ENCLOSE W-2's)

8a.

Add 8a and 8b

TOTAL ESTIMATED PAYMENTS AND PRIOR YEAR CREDITS 8b.

8c.

9. IF LINE 7 IS LARGER THAN LINE 8c, ENTER UNPAID BALANCE

DO NOT ROUND OFF

($32.00 SERVICE CHARGE WILL BE ADDED TO ALL RETURNED CHECKS)

10. IF LINE 8c IS LARGER THAN LINE 7, ENTER REFUND DUE HERE (SEE INSTRUCTIONS)

11. INTEREST AND PENALTY (SEE INSTRUCTIONS)

11a.

11b. PAY BALANCE DUE (LINE 9 PLUS LINE 11a)

DO NOT ROUND OFF

TOTAL AMOUNTS OF LESS THAN $1.00 NEED NOT BE PAID, NOR WILL THEY BE REFUNDED

I DECLARE UNDER PENALTIES PROVIDED BY LAW, THAT THIS RETURN HAS BEEN EXAMINED BY ME AND IS, TO THE BEST OF MY

KNOWLEDGE, A COMPLETE RETURN.

SIGNATURE

DATE

PHONE NUMBER

SOCIAL SECURITY #

REQUIRED

TAX PREPARER'S SIGNATURE

DATE

1

1 2

2