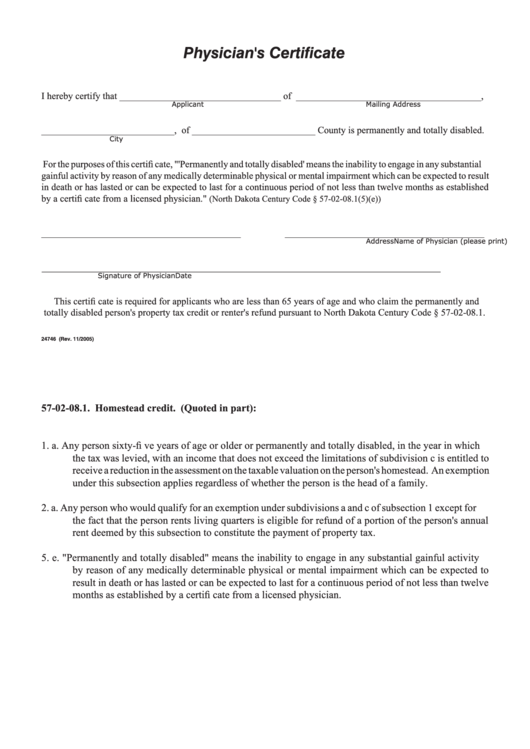

Physician's Certificate

I hereby certify that __________________________________ of _______________________________________,

Mailing Address

Applicant

____________________________, of __________________________ County is permanently and totally disabled.

City

For the purposes of this certifi cate, "'Permanently and totally disabled' means the inability to engage in any substantial

gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result

in death or has lasted or can be expected to last for a continuous period of not less than twelve months as established

by a certifi cate from a licensed physician."

(North Dakota Century Code § 57-02-08.1(5)(e))

__________________________________________

__________________________________________

Name of Physician (please print)

Address

__________________________________________

__________________________________________

Signature of Physician

Date

This certifi cate is required for applicants who are less than 65 years of age and who claim the permanently and

totally disabled person's property tax credit or renter's refund pursuant to North Dakota Century Code § 57-02-08.1.

24746 (Rev. 11/2005)

57-02-08.1. Homestead credit. (Quoted in part):

1. a.

Any person sixty-fi ve years of age or older or permanently and totally disabled, in the year in which

the tax was levied, with an income that does not exceed the limitations of subdivision c is entitled to

receive a reduction in the assessment on the taxable valuation on the person's homestead. An exemption

under this subsection applies regardless of whether the person is the head of a family.

2. a.

Any person who would qualify for an exemption under subdivisions a and c of subsection 1 except for

the fact that the person rents living quarters is eligible for refund of a portion of the person's annual

rent deemed by this subsection to constitute the payment of property tax.

5. e.

"Permanently and totally disabled" means the inability to engage in any substantial gainful activity

by reason of any medically determinable physical or mental impairment which can be expected to

result in death or has lasted or can be expected to last for a continuous period of not less than twelve

months as established by a certifi cate from a licensed physician.

1

1