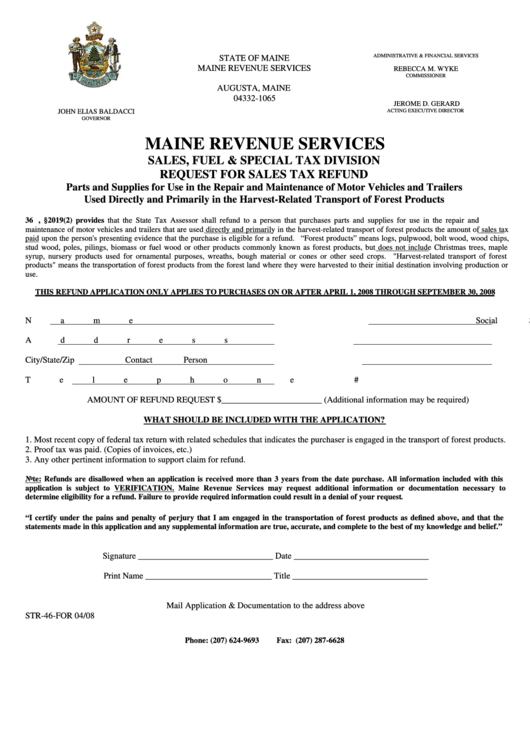

Form Str-46-For - Request For Sales Tax Refund

ADVERTISEMENT

ADMINISTRATIVE & FINANCIAL SERVICES

STATE OF MAINE

MAINE REVENUE SERVICES

REBECCA M. WYKE

COMMISSIONER

P.O. BOX 1065

AUGUSTA, MAINE

04332-1065

JEROME D. GERARD

ACTING EXECUTIVE DIRECTOR

JOHN ELIAS BALDACCI

GOVERNOR

MAINE REVENUE SERVICES

SALES, FUEL & SPECIAL TAX DIVISION

REQUEST FOR SALES TAX REFUND

Parts and Supplies for Use in the Repair and Maintenance of Motor Vehicles and Trailers

Used Directly and Primarily in the Harvest-Related Transport of Forest Products

36 M.R.S.A., §2019(2) provides that the State Tax Assessor shall refund to a person that purchases parts and supplies for use in the repair and

maintenance of motor vehicles and trailers that are used directly and primarily in the harvest-related transport of forest products the amount of sales tax

paid upon the person's presenting evidence that the purchase is eligible for a refund. “Forest products” means logs, pulpwood, bolt wood, wood chips,

stud wood, poles, pilings, biomass or fuel wood or other products commonly known as forest products, but does not include Christmas trees, maple

syrup, nursery products used for ornamental purposes, wreaths, bough material or cones or other seed crops.

"Harvest-related transport of forest

products" means the transportation of forest products from the forest land where they were harvested to their initial destination involving production or

use.

THIS REFUND APPLICATION ONLY APPLIES TO PURCHASES ON OR AFTER APRIL 1, 2008 THROUGH SEPTEMBER 30, 2008

Name

Social Security #

Address

Federal ID #

City/State/Zip

Contact Person

Telephone #

AMOUNT OF REFUND REQUEST $_______________________

(Additional information may be required)

WHAT SHOULD BE INCLUDED WITH THE APPLICATION?

1. Most recent copy of federal tax return with related schedules that indicates the purchaser is engaged in the transport of forest products.

2. Proof tax was paid. (Copies of invoices, etc.)

3. Any other pertinent information to support claim for refund.

Note: Refunds are disallowed when an application is received more than 3 years from the date purchase. All information included with this

application is subject to VERIFICATION. Maine Revenue Services may request additional information or documentation necessary to

determine eligibility for a refund. Failure to provide required information could result in a denial of your request.

“I certify under the pains and penalty of perjury that I am engaged in the transportation of forest products as defined above, and that the

statements made in this application and any supplemental information are true, accurate, and complete to the best of my knowledge and belief.”

Signature _______________________________ Date _______________________________

Print Name _____________________________ Title _______________________________

Mail Application & Documentation to the address above

STR-46-FOR 04/08

Phone: (207) 624-9693

Fax: (207) 287-6628

Sales.tax@maine.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1