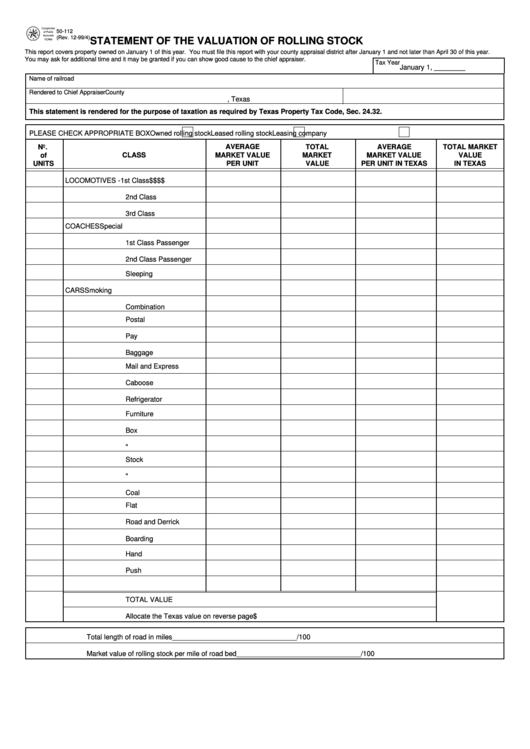

Form 50-112 - Statement Of The Valuation Of Rolling Stock

ADVERTISEMENT

50-112

(Rev. 12-99/4)

STATEMENT OF THE VALUATION OF ROLLING STOCK

This report covers property owned on January 1 of this year. You must file this report with your county appraisal district after January 1 and not later than April 30 of this year.

You may ask for additional time and it may be granted if you can show good cause to the chief appraiser.

Tax Year

January 1, ________

Name of railroad

Rendered to Chief Appraiser

County

, Texas

This statement is rendered for the purpose of taxation as required by Texas Property Tax Code, Sec. 24.32.

PLEASE CHECK APPROPRIATE BOX

Owned rolling stock

Leased rolling stock

Leasing company

No.

AVERAGE

TOTAL

AVERAGE

TOTAL MARKET

of

CLASS

MARKET VALUE

MARKET

MARKET VALUE

VALUE

PER UNIT

VALUE

PER UNIT IN TEXAS

IN TEXAS

UNITS

LOCOMOTIVES - 1st Class

$

$

$

$

2nd Class

3rd Class

COACHES

Special

1st Class Passenger

2nd Class Passenger

Sleeping

CARS

Smoking

Combination

Postal

Pay

Baggage

Mail and Express

Caboose

Refrigerator

Furniture

Box

"

Stock

"

Coal

Flat

Road and Derrick

Boarding

Hand

Push

TOTAL VALUE

Allocate the Texas value on reverse page

$

Total length of road in miles

________________

________________

/100

Market value of rolling stock per mile of road bed

________________

________________

/100

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2