Ets Form 001 7/02/03 - Sales/use Tax License Application Form 2003

ADVERTISEMENT

Department Use Only

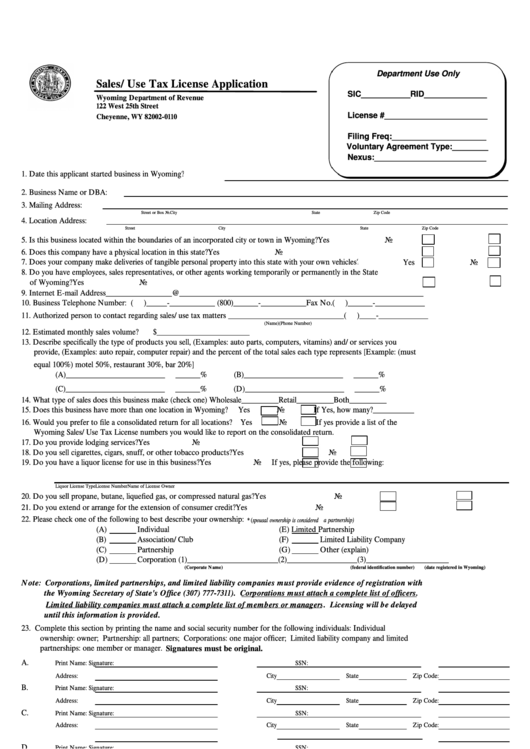

Sales/Use Tax License Application

SIC___________RID______________

Wyoming Department of Revenue

122 West 25th Street

License #_______________________

Cheyenne, WY 82002-0110

Filing Freq:_____________________

Voluntary Agreement Type:________

Nexus:_________________________

1. Date this applicant started business in Wyoming?

2. Business Name or DBA:

3. Mailing Address:

Street or Box No.

City

State

Zip Code

4. Location Address:

Street

City

State

Zip Code

5. Is this business located within the boundaries of an incorporated city or town in Wyoming?

Yes

No

6. Does this company have a physical location in this state?

Yes

No

7. Does your company make deliveries of tangible personal property into this state with your own vehicles?

Yes

No

8. Do you have employees, sales representatives, or other agents working temporarily or permanently in the State

of Wyoming?

Yes

No

9. Internet E-mail Address________________@___________________________________________________________

10. Business Telephone Number: (

)_____-___________ (800)______-___________Fax No.(

)______-____________

11. Authorized person to contact regarding sales/use tax matters ____________________________(

)____-____________

(Name)

(Phone Number)

12. Estimated monthly sales volume?

$_______________________

13. Describe specifically the type of products you sell, (Examples: auto parts, computers, vitamins) and/or services you

provide, (Examples: auto repair, computer repair) and the percent of the total sales each type represents [Example: (must

equal 100%) motel 50%, restaurant 30%, bar 20%]

(A)________________________

______%

(B)________________________

______%

(C)________________________

______%

(D)________________________

______%

14. What type of sales does this business make (check one) Wholesale_________Retail_________Both_________

15. Does this business have more than one location in Wyoming?

Yes

No

If Yes, how many?__________

16. Would you prefer to file a consolidated return for all locations? Yes

No

If yes provide a list of the

Wyoming Sales/Use Tax License numbers you would like to report on the consolidated return.

17. Do you provide lodging services?

Yes

No

18. Do you sell cigarettes, cigars, snuff, or other tobacco products?

Yes

No

19. Do you have a liquor license for use in this business?

Yes

No

If yes, please provide the following:

Liquor License Type

License Number

Name of License Owner

20. Do you sell propane, butane, liquefied gas, or compressed natural gas?

Yes

No

21. Do you extend or arrange for the extension of consumer credit?

Yes

No

22. Please check one of the following to best describe your ownership:

* (spousal ownership is considered a partnership)

(A)

Individual

(E)

Limited Partnership

(B)

Association/Club

(F)

Limited Liability Company

(C)

Partnership

(G)

Other (explain)

(D)

Corporation (1)______________________(2)_________________(3)____________________

(Corporate Name)

(federal identification number)

(date registered in Wyoming)

Note: Corporations, limited partnerships, and limited liability companies must provide evidence of registration with

the Wyoming Secretary of State's Office (307) 777-7311). Corporations must attach a complete list of officers .

Limited liability companies must attach a complete list of members or managers . Licensing will be delayed

until this information is provided.

23. Complete this section by printing the name and social security number for the following individuals: Individual

ownership: owner; Partnership: all partners; Corporations: one major officer; Limited liability company and limited

partnerships: one member or manager. Signatures must be original.

A.

Print Name:

Signature:

SSN:

Address:

City

State

Zip Code:

B.

Print Name:

Signature:

SSN:

Address:

City

State

Zip Code:

C.

Print Name:

Signature:

SSN:

Address:

City

State

Zip Code:

D.

Print Name:

Signature:

SSN:

Address:

City

State

Zip Code:

Don't Forget! Include the $60.00 non-refundable application fee. - Get all signatures required.

Complete this application in its entirety and attach all required documentation.

Incomplete applications will be returned and licensing delayed.

Call Taxpayer Services at (307) 777-5200 for assistance in completing application.

ETS Form 001 (Revised 7/02/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1