Print

Clear

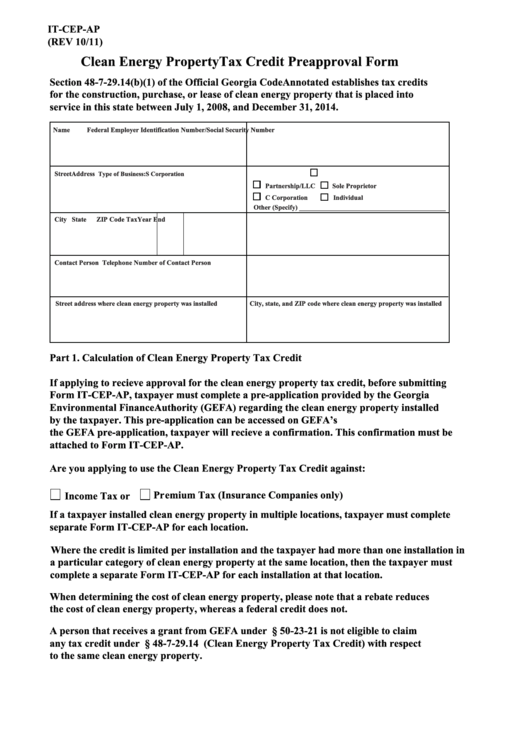

IT-CEP-AP

(REV 10/11)

Clean Energy Property Tax Credit Preapproval Form

Section 48-7-29.14(b)(1) of the Official Georgia Code Annotated establishes tax credits

for the construction, purchase, or lease of clean energy property that is placed into

service in this state between July 1, 2008, and December 31, 2014.

Name

Federal Employer Identification Number/Social Security Number

Street Address

Type of Business:

S Corporation

Partnership/LLC

Sole Proprietor

C Corporation

Individual

Other (Specify) ___________________________________________

City

State

ZIP Code

Tax Year End

Contact Person

Telephone Number of Contact Person

Street address where clean energy property was installed

City, state, and ZIP code where clean energy property was installed

Part 1. Calculation of Clean Energy Property Tax Credit

If applying to recieve approval for the clean energy property tax credit, before submitting

Form IT-CEP-AP, taxpayer must complete a pre-application provided by the Georgia

Environmental Finance Authority (GEFA) regarding the clean energy property installed

by the taxpayer. This pre-application can be accessed on GEFA’s website. After completing

the GEFA pre-application, taxpayer will recieve a confirmation. This confirmation must be

attached to Form IT-CEP-AP.

Are you applying to use the Clean Energy Property Tax Credit against:

Pr

emium Tax (Insurance Companies only)

Income Tax or

If a taxpayer installed clean energy property in multiple locations, taxpayer must complete

separate Form IT-CEP-AP for each location.

Where the credit is limited per installation and the taxpayer had more than one installation in

a particular category of clean energy property at the same location, then the taxpayer must

complete a separate Form IT-CEP-AP for each installation at that location.

When determining the cost of clean energy property, please note that a rebate reduces

the cost of clean energy property, whereas a federal credit does not.

A person that receives a grant from GEFA under O.C.G.A. § 50-23-21 is not eligible to claim

any tax credit under O.C.G.A. § 48-7-29.14 (Clean Energy Property Tax Credit) with respect

to the same clean energy property.

1

1 2

2 3

3 4

4 5

5