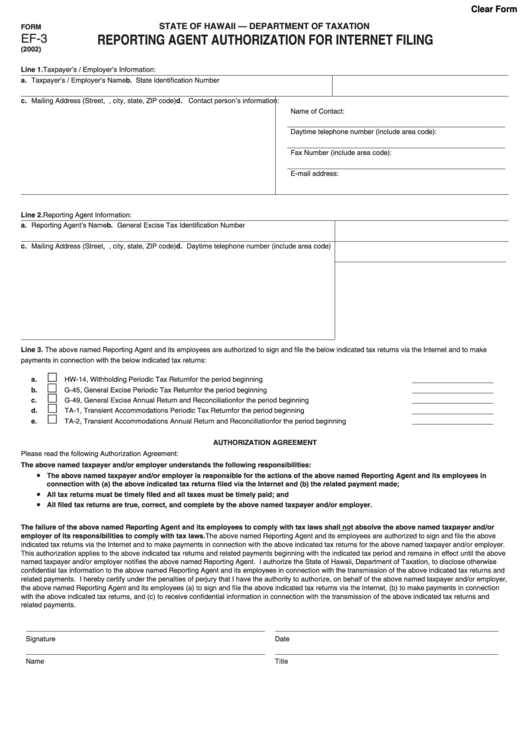

Clear Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM

EF-3

REPORTING AGENT AUTHORIZATION FOR INTERNET FILING

(2002)

Line 1.

Taxpayer’s / Employer’s Information:

a. Taxpayer’s / Employer’s Name

b. State Identification Number

c. Mailing Address (Street, P.O. Box, city, state, ZIP code)

d. Contact person’s information:

Name of Contact:

Daytime telephone number (include area code):

Fax Number (include area code):

E-mail address:

Line 2.

Reporting Agent Information:

a. Reporting Agent’s Name

b. General Excise Tax Identification Number

c. Mailing Address (Street, P.O. Box, city, state, ZIP code)

d. Daytime telephone number (include area code)

Line 3. The above named Reporting Agent and its employees are authorized to sign and file the below indicated tax returns via the Internet and to make

payments in connection with the below indicated tax returns:

£

a.

HW-14, Withholding Periodic Tax Return

for the period beginning

£

b.

G-45, General Excise Periodic Tax Return

for the period beginning

£

c.

G-49, General Excise Annual Return and Reconciliation

for the period beginning

£

d.

TA-1, Transient Accommodations Periodic Tax Return

for the period beginning

£

e.

TA-2, Transient Accommodations Annual Return and Reconciliation

for the period beginning

AUTHORIZATION AGREEMENT

Please read the following Authorization Agreement:

The above named taxpayer and/or employer understands the following responsibilities:

•

The above named taxpayer and/or employer is responsible for the actions of the above named Reporting Agent and its employees in

connection with (a) the above indicated tax returns filed via the Internet and (b) the related payment made;

•

All tax returns must be timely filed and all taxes must be timely paid; and

•

All filed tax returns are true, correct, and complete by the above named taxpayer and/or employer.

The failure of the above named Reporting Agent and its employees to comply with tax laws shall not absolve the above named taxpayer and/or

employer of its responsibilities to comply with tax laws. The above named Reporting Agent and its employees are authorized to sign and file the above

indicated tax returns via the Internet and to make payments in connection with the above indicated tax returns for the above named taxpayer and/or employer.

This authorization applies to the above indicated tax returns and related payments beginning with the indicated tax period and remains in effect until the above

named taxpayer and/or employer notifies the above named Reporting Agent. I authorize the State of Hawaii, Department of Taxation, to disclose otherwise

confidential tax information to the above named Reporting Agent and its employees in connection with the transmission of the above indicated tax returns and

related payments. I hereby certify under the penalties of perjury that I have the authority to authorize, on behalf of the above named taxpayer and/or employer,

the above named Reporting Agent and its employees (a) to sign and file the above indicated tax returns via the Internet, (b) to make payments in connection

with the above indicated tax returns, and (c) to receive confidential information in connection with the transmission of the above indicated tax returns and

related payments.

Signature

Date

Name

Title

1

1