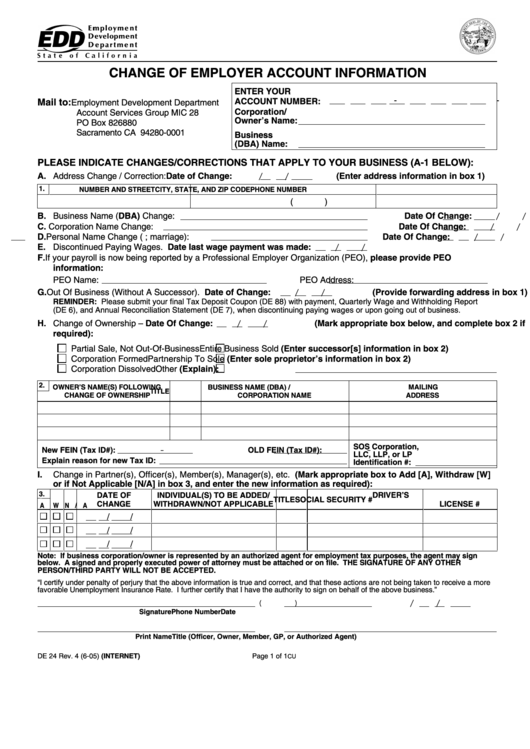

CHANGE OF EMPLOYER ACCOUNT INFORMATION

ENTER YOUR E.D.D.

-

-

ACCOUNT NUMBER:

Mail to:

Employment Development Department

Corporation/

Account Services Group MIC 28

Owner’s Name:

PO Box 826880

Sacramento CA 94280-0001

Business

(DBA) Name:

PLEASE INDICATE CHANGES/CORRECTIONS THAT APPLY TO YOUR BUSINESS (A-1 BELOW):

A. Address Change / Correction:

Date of Change:

(Enter address information in box 1)

/

/

1.

NUMBER AND STREET

CITY, STATE, AND ZIP CODE

PHONE NUMBER

(

)

B. Business Name (DBA) Change:

Date Of Change:

/

/

C. Corporation Name Change:

Date Of Change:

/

/

D. Personal Name Change (i.e.; marriage):

Date Of Change:

/

/

E. Discontinued Paying Wages. Date last wage payment was made:

/

/

F. If your payroll is now being reported by a Professional Employer Organization (PEO), please provide PEO

information:

PEO Name:

PEO Address:

G. Out Of Business (Without A Successor). Date of Change:

(Provide forwarding address in box 1)

/

/

REMINDER: Please submit your final Tax Deposit Coupon (DE 88) with payment, Quarterly Wage and Withholding Report

(DE 6), and Annual Reconciliation Statement (DE 7), when discontinuing paying wages or upon going out of business.

H. Change of Ownership – Date Of Change:

(Mark appropriate box below, and complete box 2 if

/

/

required):

Partial Sale, Not Out-Of-Business

Entire Business Sold (Enter successor[s] information in box 2)

Corporation Formed

Partnership To Sole (Enter sole proprietor’s information in box 2)

Corporation Dissolved

Other (Explain):

2.

OWNER’S NAME(S) FOLLOWING

BUSINESS NAME (DBA) /

MAILING

TITLE

CHANGE OF OWNERSHIP

CORPORATION NAME

ADDRESS

SOS Corporation,

New FEIN (Tax ID#):

-

OLD FEIN (Tax ID#):

-

LLC, LLP, or LP

Explain reason for new Tax ID:

Identification #:

I.

Change in Partner(s), Officer(s), Member(s), Manager(s), etc. (Mark appropriate box to Add [A], Withdraw [W]

or if Not Applicable [N/A] in box 3, and enter the new information as required):

3.

DATE OF

INDIVIDUAL(S) TO BE ADDED/

DRIVER’S

TITLE

SOCIAL SECURITY #

CHANGE

WITHDRAWN/NOT APPLICABLE

LICENSE #

A

W N/A

/

/

/

/

/

/

Note: If business corporation/owner is represented by an authorized agent for employment tax purposes, the agent may sign

below. A signed and properly executed power of attorney must be attached or on file. THE SIGNATURE OF ANY OTHER

PERSON/THIRD PARTY WILL NOT BE ACCEPTED.

“I certify under penalty of perjury that the above information is true and correct, and that these actions are not being taken to receive a more

favorable Unemployment Insurance Rate. I further certify that I have the authority to sign on behalf of the above business.”

(

)

/

/

Signature

Phone Number

Date

Print Name

Title (Officer, Owner, Member, GP, or Authorized Agent)

DE 24 Rev. 4 (6-05) (INTERNET)

Page 1 of 1

CU

1

1