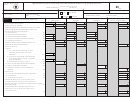

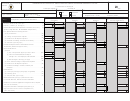

Schedule Nr Form 504 - Computation Of The Maryland Modification For A Nonresident Fiduciary - 2007

ADVERTISEMENT

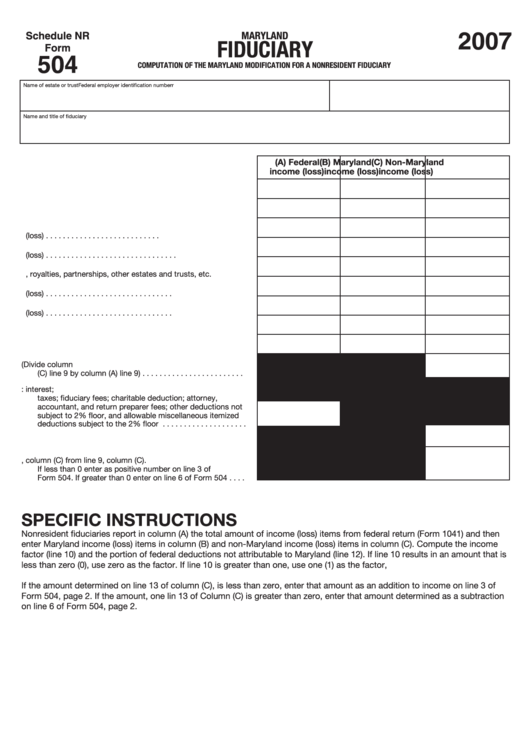

Schedule NR

MARYLAND

2007

FIDUCIARY

Form

504

COMPUTATION OF THE MARYLAND MODIFICATION FOR A NONRESIDENT FIDUCIARY

Name of estate or trust

Federal employer identification numberr

Name and title of fiduciary

(A) Federal

(B) Maryland

(C) Non-Maryland

income (loss)

income (loss)

income (loss)

1. Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Rents, royalties, partnerships, other estates and trusts, etc.

6. Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Ordinary gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Other income. Specify type and amount __ __ __ __ __ __

9. Total income. Combine lines 1 through 8 . . . . . . . . . . . . . . .

10. Income factor (Divide column

(C) line 9 by column (A) line 9) . . . . . . . . . . . . . . . . . . . . . . . .

11. Enter the total of the following federal deductions: interest;

taxes; fiduciary fees; charitable deduction; attorney,

accountant, and return preparer fees; other deductions not

subject to 2% floor, and allowable miscellaneous itemized

deductions subject to the 2% floor . . . . . . . . . . . . . . . . . . . .

12. Multiply line 11 by line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Subtract line 12, column (C) from line 9, column (C).

If less than 0 enter as positive number on line 3 of

Form 504. If greater than 0 enter on line 6 of Form 504 . . . .

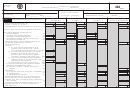

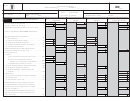

SPECIFIC INSTRUCTIONS

Nonresident fiduciaries report in column (A) the total amount of income (loss) items from federal return (Form 1041) and then

enter Maryland income (loss) items in column (B) and non-Maryland income (loss) items in column (C). Compute the income

factor (line 10) and the portion of federal deductions not attributable to Maryland (line 12). If line 10 results in an amount that is

less than zero (0), use zero as the factor. If line 10 is greater than one, use one (1) as the factor,

If the amount determined on line 13 of column (C), is less than zero, enter that amount as an addition to income on line 3 of

Form 504, page 2. If the amount, one lin 13 of Column (C) is greater than zero, enter that amount determined as a subtraction

on line 6 of Form 504, page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1