Form Wv/tel-501 - Telecommunications Tax Return - 2006

ADVERTISEMENT

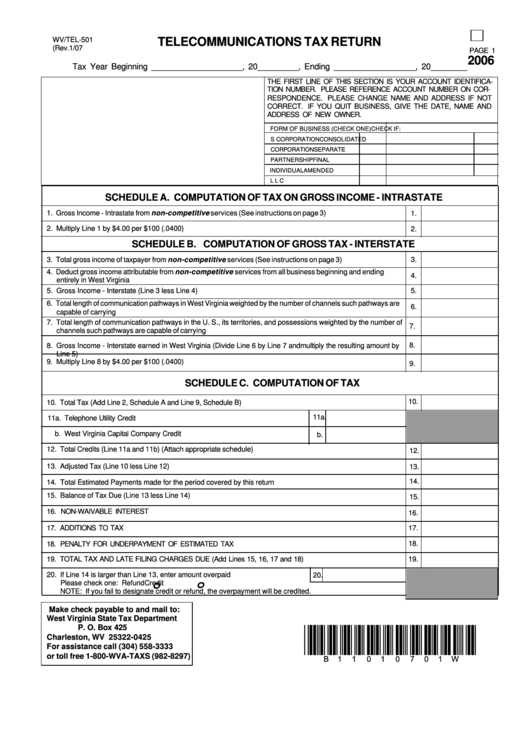

WV/TEL-501

TELECOMMUNICATIONS TAX RETURN

(Rev.1/07

PAGE 1

2006

Tax Year Beginning ____________________, 20_________, Ending __________________, 20________

THE FIRST LINE OF THIS SECTION IS YOUR ACCOUNT IDENTIFICA-

TION NUMBER. PLEASE REFERENCE ACCOUNT NUMBER ON COR-

RESPONDENCE. PLEASE CHANGE NAME AND ADDRESS IF NOT

CORRECT. IF YOU QUIT BUSINESS, GIVE THE DATE, NAME AND

ADDRESS OF NEW OWNER.

FORM OF BUSINESS (CHECK ONE)

CHECK IF:

S CORPORATION

CONSOLIDATED

CORPORATION

SEPARATE

PARTNERSHIP

FINAL

INDIVIDUAL

AMENDED

L L C

SCHEDULE A. COMPUTATION OF TAX ON GROSS INCOME - INTRASTATE

1. Gross Income - Intrastate from non-competitive services (See instructions on page 3)

1.

2. Multiply Line 1 by $4.00 per $100 (.0400)

2.

SCHEDULE B. COMPUTATION OF GROSS TAX - INTERSTATE

3. Total gross income of taxpayer from non-competitive services (See instructions on page 3)

3.

4. Deduct gross income attributable from non-competitive services from all business beginning and ending

4.

entirely in West Virginia

5. Gross Income - Interstate (Line 3 less Line 4)

5.

6. Total length of communication pathways in West Virginia weighted by the number of channels such pathways are

6.

capable of carrying

7. Total length of communication pathways in the U. S., its territories, and possessions weighted by the number of

7.

channels such pathways are capable of carrying

8.

8. Gross Income - Interstate earned in West Virginia (Divide Line 6 by Line 7 andmultiply the resulting amount by

Line 5)

9. Multiply Line 8 by $4.00 per $100 (.0400)

9.

SCHEDULE C. COMPUTATION OF TAX

10.

10. Total Tax (Add Line 2, Schedule A and Line 9, Schedule B)

11a.

11a. Telephone Utility Credit

b. West Virginia Capital Company Credit

b.

12. Total Credits (Line 11a and 11b) (Attach appropriate schedule)

12.

13. Adjusted Tax (Line 10 less Line 12)

13.

14.

14. Total Estimated Payments made for the period covered by this return

15. Balance of Tax Due (Line 13 less Line 14)

15.

16. NON-WAIVABLE INTEREST

16.

17. ADDITIONS TO TAX

17.

18.

18. PENALTY FOR UNDERPAYMENT OF ESTIMATED TAX

19. TOTAL TAX AND LATE FILING CHARGES DUE (Add Lines 15, 16, 17 and 18)

19.

20. If Line 14 is larger than Line 13, enter amount overpaid

20.

o

Please check one: Refund

o

Credit

NOTE: If you fail to designate credit or refund, the overpayment will be credited.

Make check payable to and mail to:

West Virginia State Tax Department

P. O. Box 425

*B11010701W*

Charleston, WV 25322-0425

For assistance call (304) 558-3333

or toll free 1-800-WVA-TAXS (982-8297)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2