Form W-4v - Voluntary Withholding From Unemployment Compensation - 2006

ADVERTISEMENT

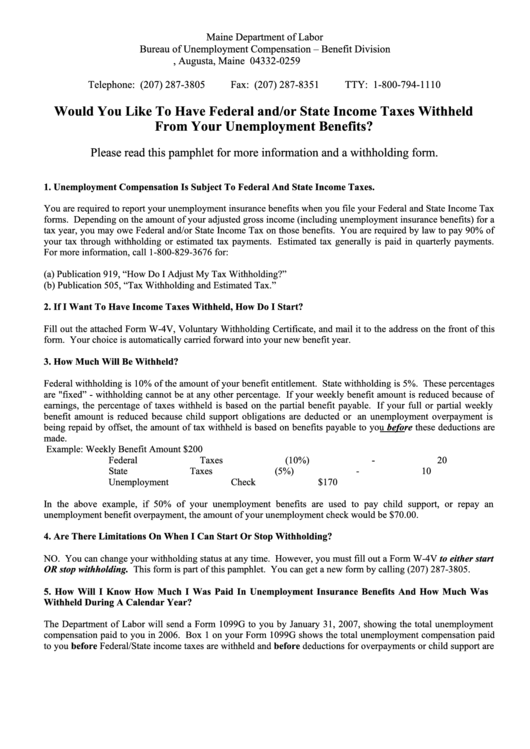

Maine Department of Labor

Bureau of Unemployment Compensation – Benefit Division

P.O. Box 259, Augusta, Maine 04332-0259

Telephone: (207) 287-3805

Fax: (207) 287-8351

TTY: 1-800-794-1110

Would You Like To Have Federal and/or State Income Taxes Withheld

From Your Unemployment Benefits?

Please read this pamphlet for more information and a withholding form.

1. Unemployment Compensation Is Subject To Federal And State Income Taxes.

You are required to report your unemployment insurance benefits when you file your Federal and State Income Tax

forms. Depending on the amount of your adjusted gross income (including unemployment insurance benefits) for a

tax year, you may owe Federal and/or State Income Tax on those benefits. You are required by law to pay 90% of

your tax through withholding or estimated tax payments. Estimated tax generally is paid in quarterly payments.

For more information, call 1-800-829-3676 for:

(a) Publication 919, “How Do I Adjust My Tax Withholding?”

(b) Publication 505, “Tax Withholding and Estimated Tax.”

2. If I Want To Have Income Taxes Withheld, How Do I Start?

Fill out the attached Form W-4V, Voluntary Withholding Certificate, and mail it to the address on the front of this

form. Your choice is automatically carried forward into your new benefit year.

3. How Much Will Be Withheld?

Federal withholding is 10% of the amount of your benefit entitlement. State withholding is 5%. These percentages

are "fixed” - withholding cannot be at any other percentage. If your weekly benefit amount is reduced because of

earnings, the percentage of taxes withheld is based on the partial benefit payable. If your full or partial weekly

benefit amount is reduced because child support obligations are deducted or an unemployment overpayment is

being repaid by offset, the amount of tax withheld is based on benefits payable to you before these deductions are

made.

Example:

Weekly Benefit Amount

$200

Federal Taxes (10%)

- 20

State Taxes (5%)

- 10

Unemployment Check

$170

In the above example, if 50% of your unemployment benefits are used to pay child support, or repay an

unemployment benefit overpayment, the amount of your unemployment check would be $70.00.

4. Are There Limitations On When I Can Start Or Stop Withholding?

NO. You can change your withholding status at any time. However, you must fill out a Form W-4V to either start

OR stop withholding. This form is part of this pamphlet. You can get a new form by calling (207) 287-3805.

5. How Will I Know How Much I Was Paid In Unemployment Insurance Benefits And How Much Was

Withheld During A Calendar Year?

The Department of Labor will send a Form 1099G to you by January 31, 2007, showing the total unemployment

compensation paid to you in 2006. Box 1 on your Form 1099G shows the total unemployment compensation paid

to you before Federal/State income taxes are withheld and before deductions for overpayments or child support are

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2