Tax Organizer Template For 2015

ADVERTISEMENT

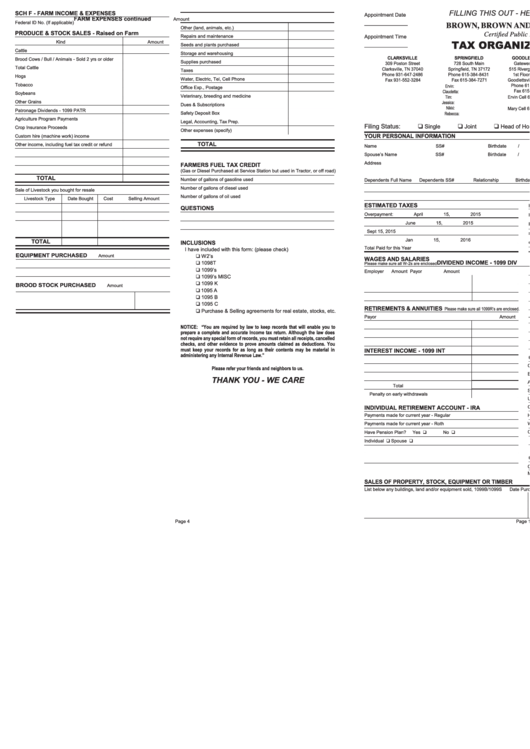

FILLING THIS OUT - HELPS US HELP YOU.

SCH F - FARM INCOME & EXPENSES

Appointment Date

FARM EXPENSES continued

Amount

Federal ID No. (If applicable)

_______________

Thank you for

BROWN, BROWN AND ASSOCIATES, P.C.

Other (land, animals, etc.)

your referrals.

PRODUCE & STOCK SALES - Raised on Farm

Certified Public Accountants

Repairs and maintenance

Appointment Time

TAX ORGANIZER for 2015

Kind

Amount

Seeds and plants purchased

_______________

Cattle

Storage and warehousing

CLARKSVILLE

SPRINGFIELD

GOODLETTSVILLE

KNOXVILLE

SEVIERVILLE

Brood Cows / Bull / Animals - Sold 2 yrs or older

Supplies purchased

309 Poston Street

728 South Main

Gatewest Building

4505 Greenway Drive

109 Parkway, Suite 1

Total Cattle

Clarksville, TN 37040

Springfield, TN 37172

515 Rivergate Parkway

Knoxville, TN 37918

Sevierville, TN 37862

Taxes

Phone 931-647-2486

Phone 615-384-8431

1st Floor, Suite 115

Phone 865-673-9798

Phone 865-428-2824

Hogs

Water, Electric, Tel, Cell Phone

Fax 931-552-3284

Fax 615-384-7271

Goodlettsville, TN 37072

Fax 865-524-1509

Fax 865-428-8880

Tobacco

Ervin: brbrasso@bellsouth.net

Phone 615-227-0622

Duane: bbasheena@bellsouth.net

Office Exp., Postage

Fax 615-851-9962

Claudetta: cpacsm@bellsouth.net

Ellen:

Soybeans

Veterinary, breeding and medicine

Tim: tewingcpa@bellsouth.net

Teresa:

Ervin Cell 615-415-6037

Other Grains

brbrasso@bellsouth.net

Jessica: bbajessica@bellsouth.net

Tina:

Dues & Subscriptions

Nikki: bbanikki@bellsouth.net

Mary Cell 615-415-6040

Patronage Dividends - 1099 PATR

Safety Deposit Box

Rebecca: bbarebecca@att.net

Agriculture Program Payments

Legal, Accounting, Tax Prep.

Filing Status:

Single

Joint

Head of Household

Married - Filing Separately

❑

❑

❑

❑

Crop Insurance Proceeds

Other expenses (specify)

YOUR PERSONAL INFORMATION

Custom hire (machine work) income

TOTAL

Other income, including fuel tax credit or refund

Name

SS#

Birthdate

/

/

Occupation

Work #

Spouse’s Name

SS#

Birthdate

/

/

Occupation

Work #

Address

FARMERS FUEL TAX CREDIT

(Gas or Diesel Purchased at Service Station but used in Tractor, or off road)

TOTAL

Number of gallons of gasoline used

Dependents Full Name

Dependents SS#

Relationship

Birthdate

Number of gallons of diesel used

Sale of Livestock you bought for resale

Number of gallons of oil used

Livestock Type

Date Bought

Cost

Selling Amount

ESTIMATED TAXES

Have Qualifying Health Insurance Coverage

Yes / No

QUESTIONS

Overpayment:

April 15, 2015

Have 1095- A, B, C

Yes / No

June 15, 2015

If no, specify if you have Non-Qualifying Insurance or None

Sept 15, 2015

skype address

Jan 15, 2016

TOTAL

INCLUSIONS

e-mail address

Total Paid for this Year

I have included with this form: (please check)

EQUIPMENT PURCHASED

Amount

❑ W2’s

WAGES AND SALARIES

DIVIDEND INCOME - 1099 DIV

❑ 1098T

Please make sure all W-2s are enclosed

❑ 1099’s

Employer

Amount

Payor

Amount

❑ 1099’s MISC

❑ 1099 K

BROOD STOCK PURCHASED

Amount

❑ 1095 A

❑ 1095 B

❑ 1095 C

RETIREMENTS & ANNUITIES

Please make sure all 1099R’s are enclosed.

❑ Purchase & Selling agreements for real estate, stocks, etc.

Payor

Amount

TAX EXEMPT INTEREST INCOME

NOTICE: “You are required by law to keep records that will enable you to

Amount

prepare a complete and accurate Income tax return. Although the law does

not require any special form of records, you must retain all receipts, cancelled

checks, and other evidence to prove amounts claimed as deductions. You

must keep your records for as long as their contents may be material in

INTEREST INCOME - 1099 INT

administering any Internal Revenue Law.”

OTHER INCOME

Amount

Commissions

Please refer your friends and neighbors to us.

Bonuses & Prizes

THANK YOU - WE CARE

Alimony received

Total

State Tax refund

Penalty on early withdrawals

Unemployment Compensation

INDIVIDUAL RETIREMENT ACCOUNT - IRA

Gambling / Lottery

Payments made for current year - Regular

Husband’s Social Security / Railroad Retirement

Wife Social Security / Railroad Retirement

Payments made for current year - Roth

Have Pension Plan?

Yes ❑

No ❑

Other (List)

Individual ❑

Spouse ❑

CANCELLATION OF DEBT / 1099C

Amount

Credit Cards or Other

Mortgages

SALES OF PROPERTY, STOCK, EQUIPMENT OR TIMBER

List below any buildings, land and/or equipment sold, 1099B/1099S

Date Purchased

Purchase Price

Date Sold

Sales

Page 4

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2