Instructions For Filling Out The I-9 Form, The W-4 And The Ct W-4 Template

ADVERTISEMENT

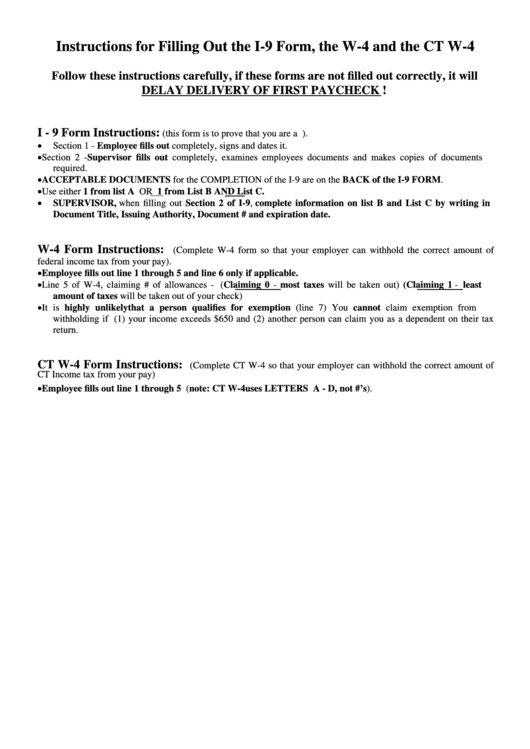

Instructions for Filling Out the I-9 Form, the W-4 and the CT W-4

Follow these instructions carefully, if these forms are not filled out correctly, it will

DELAY DELIVERY OF FIRST PAYCHECK !

I - 9 Form Instructions:

(this form is to prove that you are a U.S. Citizen).

•

Section 1 - Employee fills out completely, signs and dates it.

•

Section 2 -Supervisor fills out completely, examines employees documents and makes copies of documents

required.

•

ACCEPTABLE DOCUMENTS for the COMPLETION of the I-9 are on the BACK of the I-9 FORM.

•

Use either 1 from list A OR 1 from List B AND List C.

•

SUPERVISOR, when filling out Section 2 of I-9, complete information on list B and List C by writing in

Document Title, Issuing Authority, Document # and expiration date.

W-4 Form Instructions:

(Complete W-4 form so that your employer can withhold the correct amount of

federal income tax from your pay).

•

Employee fills out line 1 through 5 and line 6 only if applicable.

•

Line 5 of W-4, claiming # of allowances - (Claiming 0 - most taxes will be taken out) (Claiming 1 - least

amount of taxes will be taken out of your check)

•

It is highly unlikely that a person qualifies for exemption (line 7) You cannot claim exemption from

withholding if (1) your income exceeds $650 and (2) another person can claim you as a dependent on their tax

return.

CT W-4 Form Instructions:

(Complete CT W-4 so that your employer can withhold the correct amount of

CT Income tax from your pay)

•

Employee fills out line 1 through 5 (note: CT W-4 uses LETTERS A - D, not #’s).

ADVERTISEMENT

0 votes

1

1 2

2