Certificate Of Exemption From Federal Excise Tax On Charges For Communication Services Form

ADVERTISEMENT

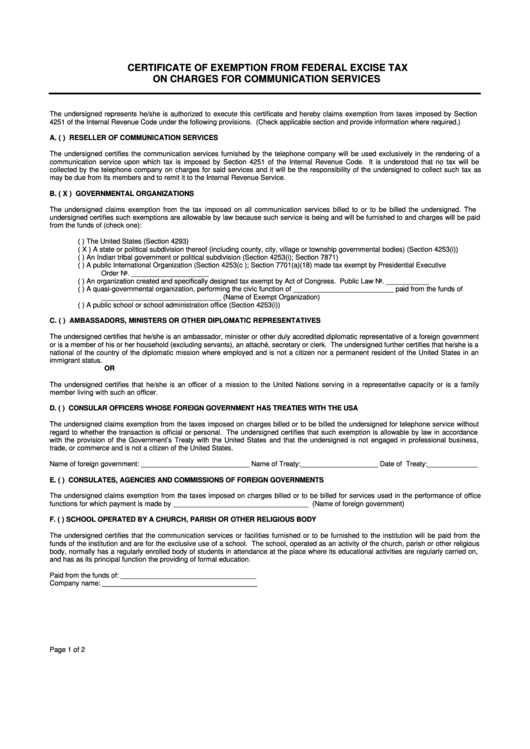

CERTIFICATE OF EXEMPTION FROM FEDERAL EXCISE TAX

ON CHARGES FOR COMMUNICATION SERVICES

The undersigned represents he/she is authorized to execute this certificate and hereby claims exemption from taxes imposed by Section

4251 of the Internal Revenue Code under the following provisions. (Check applicable section and provide information where required.)

A.

(

) RESELLER OF COMMUNICATION SERVICES

The undersigned certifies the communication services furnished by the telephone company will be used exclusively in the rendering of a

communication service upon which tax is imposed by Section 4251 of the Internal Revenue Code. It is understood that no tax will be

collected by the telephone company on charges for said services and it will be the responsibility of the undersigned to collect such tax as

may be due from its members and to remit it to the Internal Revenue Service.

B.

( X ) GOVERNMENTAL ORGANIZATIONS

The undersigned claims exemption from the tax imposed on all communication services billed to or to be billed the undersigned. The

undersigned certifies such exemptions are allowable by law because such service is being and will be furnished to and charges will be paid

from the funds of (check one):

(

)

The United States (Section 4293)

( X )

A state or political subdivision thereof (including county, city, village or township governmental bodies) (Section 4253(i))

(

)

An Indian tribal government or political subdivision (Section 4253(i); Section 7871)

(

)

A public International Organization (Section 4253(c ); Section 7701(a)(18) made tax exempt by Presidential Executive

Order No. ____________________

(

)

An organization created and specifically designed tax exempt by Act of Congress. Public Law No. ___________

(

)

A quasi-governmental organization, performing the civic function of __________________________ paid from the funds of

_______________________________ (Name of Exempt Organization)

(

)

A public school or school administration office (Section 4253(i))

C.

(

) AMBASSADORS, MINISTERS OR OTHER DIPLOMATIC REPRESENTATIVES

The undersigned certifies that he/she is an ambassador, minister or other duly accredited diplomatic representative of a foreign government

or is a member of his or her household (excluding servants), an attaché, secretary or clerk. The undersigned further certifies that he/she is a

national of the country of the diplomatic mission where employed and is not a citizen nor a permanent resident of the United States in an

immigrant status.

OR

The undersigned certifies that he/she is an officer of a mission to the United Nations serving in a representative capacity or is a family

member living with such an officer.

D.

(

) CONSULAR OFFICERS WHOSE FOREIGN GOVERNMENT HAS TREATIES WITH THE USA

The undersigned claims exemption from the taxes imposed on charges billed or to be billed the undersigned for telephone service without

regard to whether the transaction is official or personal. The undersigned certifies that such exemption is allowable by law in accordance

with the provision of the Government’s Treaty with the United States and that the undersigned is not engaged in professional business,

trade, or commerce and is not a citizen of the United States.

Name of foreign government: ____________________________ Name of Treaty:____________________ Date of Treaty:_____________

E.

(

) CONSULATES, AGENCIES AND COMMISSIONS OF FOREIGN GOVERNMENTS

The undersigned claims exemption from the taxes imposed on charges billed or to be billed for services used in the performance of office

functions for which payment is made by ___________________________________ (Name of foreign government)

F.

(

) SCHOOL OPERATED BY A CHURCH, PARISH OR OTHER RELIGIOUS BODY

The undersigned certifies that the communication services or facilities furnished or to be furnished to the institution will be paid from the

funds of the institution and are for the exclusive use of a school. The school, operated as an activity of the church, parish or other religious

body, normally has a regularly enrolled body of students in attendance at the place where its educational activities are regularly carried on,

and has as its principal function the providing of formal education.

Paid from the funds of: ___________________________________

Company name: ________________________________________

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2