Ppb-8a - Disabled American Veteran Application Form Montana

ADVERTISEMENT

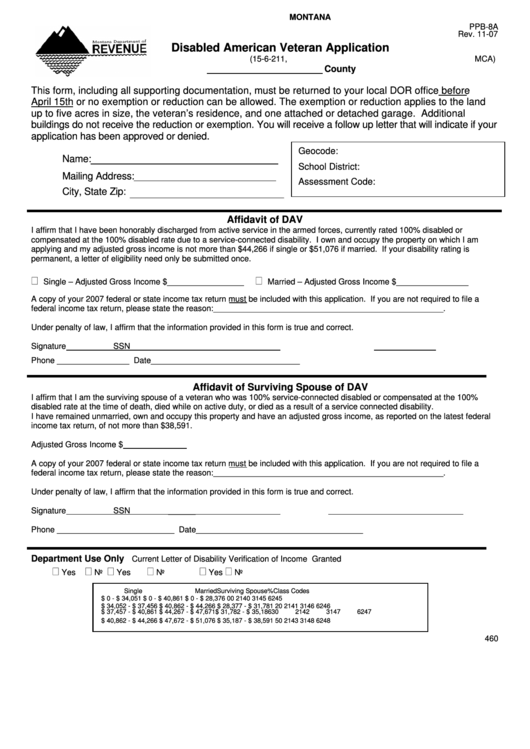

MONTANA

PPB-8A

Rev. 11-07

Disabled American Veteran Application

(15-6-211, MCA)

County

This form, including all supporting documentation, must be returned to your local DOR office before

April 15th or no exemption or reduction can be allowed. The exemption or reduction applies to the land

up to five acres in size, the veteran’s residence, and one attached or detached garage. Additional

buildings do not receive the reduction or exemption. You will receive a follow up letter that will indicate if your

application has been approved or denied.

Geocode:

Name:

School District:

Mailing Address:

Assessment Code:

City, State Zip:

Affidavit of DAV

I affirm that I have been honorably discharged from active service in the armed forces, currently rated 100% disabled or

compensated at the 100% disabled rate due to a service-connected disability. I own and occupy the property on which I am

applying and my adjusted gross income is not more than $44,266 if single or $51,076 if married. If your disability rating is

permanent, a letter of eligibility need only be submitted once.

Single – Adjusted Gross Income $_________________

Married – Adjusted Gross Income $________________

A copy of your 2007 federal or state income tax return must be included with this application. If you are not required to file a

federal income tax return, please state the reason:___________________________________________________.

Under penalty of law, I affirm that the information provided in this form is true and correct.

Signature

SSN__________

Phone ________________

Date_________________________________

Affidavit of Surviving Spouse of DAV

I affirm that I am the surviving spouse of a veteran who was 100% service-connected disabled or compensated at the 100%

disabled rate at the time of death, died while on active duty, or died as a result of a service connected disability.

I have remained unmarried, own and occupy this property and have an adjusted gross income, as reported on the latest federal

income tax return, of not more than $38,591.

Adjusted Gross Income $

A copy of your 2007 federal or state income tax return must be included with this application. If you are not required to file a

federal income tax return, please state the reason:___________________________________________________.

Under penalty of law, I affirm that the information provided in this form is true and correct.

Signature

SSN

______

Phone __________________________

Date_____________________________________

Department Use Only

Current Letter of Disability

Verification of Income

Granted

Yes

No

Yes

No

Yes

No

Single

Married

Surviving Spouse

%

Class Codes

$

0 - $

34,051

$

0 - $

40,861

$

0 - $

28,376

00

2140

3145

6245

$ 34,052 - $

37,456

$ 40,862 - $

44,266

$ 28,377 - $

31,781

20

2141

3146

6246

$ 37,457 - $

40,861

$ 44,267 - $

47,671

$ 31,782 - $

35,186

30

2142

3147

6247

$ 40,862 - $

44,266

$ 47,672 - $

51,076

$ 35,187 - $

38,591

50

2143

3148

6248

460

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1