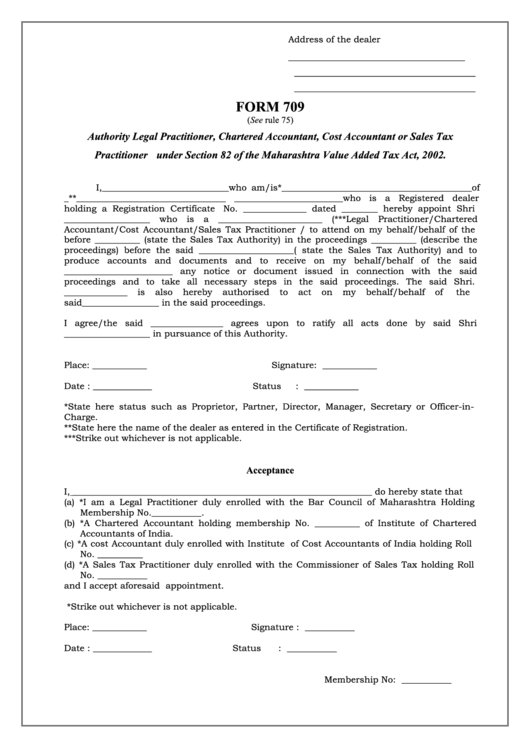

Form 709 - Authority Legal Practitioner, Chartered Accountant, Cost Accountant Or Sales Tax Practitioner Under Section 82 Of The Maharashtra Value Added Tax Act, 2002

ADVERTISEMENT

Address of the dealer

_______________________________________

________________________________________

________________________________________

FORM 709

(See rule 75)

Authority Legal Practitioner, Chartered Accountant, Cost Accountant or Sales Tax

Practitioner under Section 82 of the Maharashtra Value Added Tax Act, 2002.

I,____________________________who am/is*__________________________________________of

_**_________________________________ ________________________who is a Registered dealer

holding a Registration Certificate

No. ______________ dated ________ hereby appoint Shri

___________________

who

is

a

_______________________

(***Legal

Practitioner/Chartered

Accountant/Cost Accountant/Sales Tax Practitioner / to attend on my behalf/behalf of the

before __________ (state the Sales Tax Authority) in the proceedings __________ (describe the

proceedings) before the said _____________________( state the Sales Tax Authority) and to

produce accounts and documents and to receive on my behalf/behalf of the said

________________________ any notice or document issued in connection with the said

proceedings and to take all necessary steps in the said proceedings. The said Shri.

______________

is

also

hereby

authorised

to

act

on

my

behalf/behalf

of

the

said_________________ in the said proceedings.

I agree/the said ________________ agrees upon to ratify all acts done by said Shri

___________________ in pursuance of this Authority.

Place: ____________

Signature: ____________

Date : _____________

Status

: ____________

*State here status such as Proprietor, Partner, Director, Manager, Secretary or Officer-in-

Charge.

**State here the name of the dealer as entered in the Certificate of Registration.

***Strike out whichever is not applicable.

Acceptance

I, __________________________________________________________________ do hereby state that

(a) *I am a Legal Practitioner duly enrolled with the Bar Council of Maharashtra Holding

Membership No.___________.

(b) *A Chartered Accountant holding membership No. __________ of Institute of Chartered

Accountants of India.

(c) *A cost Accountant duly enrolled with Institute of Cost Accountants of India holding Roll

No. __________

(d) *A Sales Tax Practitioner duly enrolled with the Commissioner of Sales Tax holding Roll

No. ___________

and I accept aforesaid appointment.

*Strike out whichever is not applicable.

Place: ____________

Signature : ___________

Date : _____________

Status

: ___________

Membership No: ___________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1