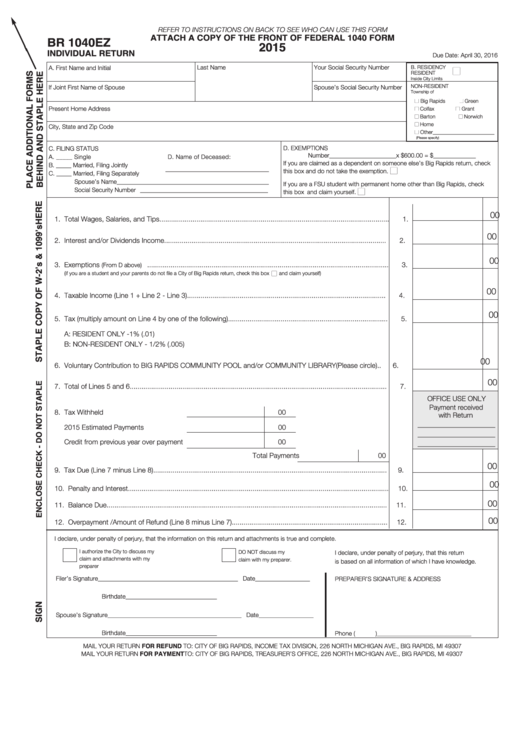

Form Br 1040ez - Attach To 1040 Form - Individual Return - 2015

ADVERTISEMENT

BR 1040EZ

ATTACH A COPY OF THE FRONT OF FEDERAL 1040 FORM

2015

RefeR to instRuctions on back to see who can use this foRm

INDIVIDUAL RETURN

Due Date: april 30, 2016

n

last name

Your Social Security number

B. RESiDEnCY

a. First name and initial

RESiDEnt

inside City limits

nOn-RESiDEnt

if Joint First name of Spouse

Spouse’s Social Security number

township of

n

n

Big Rapids

green

n

n

Present home address

Colfax

grant

n

n

Barton

norwich

n

home

City, State and Zip Code

n

Other_______________________

(Please specify)

D. EXEMPtiOnS

C. Filing StatuS

number______________________x $600.00 = $______________

a. _____ Single

D. name of Deceased:

n

if you are claimed as a dependent on someone else’s Big Rapids return, check

B. _____ Married, Filing Jointly

__________________________________

this box and do not take the exemption.

C. _____ Married, Filing Separately

Spouse’s name__________________________________________________

n

if you are a FSu student with permanent home other than Big Rapids, check

Social Security number __________________________________________

this box and claim yourself.

00

1. total Wages, Salaries, and tips......................................................................................................................

1.

00

2. interest and/or Dividends income ..................................................................................................................

2.

00

3. Exemptions

............................................................................................................................

3.

(From D above)

n

(if you are a student and your parents do not file a City of Big Rapids return, check this box

and claim yourself)

00

4. taxable income (line 1 + line 2 - line 3) ......................................................................................................

4.

00

5. tax (multiply amount on line 4 by one of the following)..................................................................................

5.

a: RESiDEnt OnlY -1% (.01)

B: nOn-RESiDEnt OnlY - 1/2% (.005)

00

6. Voluntary Contribution to Big RaPiDS COMMunitY POOl and/or COMMunitY liBRaRY (Please circle) ..

6.

00

7. total of lines 5 and 6 ....................................................................................................................................

7.

OFFiCE uSE OnlY

Payment received

8. tax Withheld

00

with Return

______________________

2015 Estimated Payments

00

______________________

Credit from previous year over payment

00

______________________

total Payments

00

00

9. tax Due (line 7 minus line 8) ........................................................................................................................

9.

00

10. Penalty and interest......................................................................................................................................

10.

00

11. Balance Due ................................................................................................................................................

11.

00

12. Overpayment /amount of Refund (line 8 minus line 7)................................................................................

12.

i declare, under penalty of perjury, that the information on this return and attachments is true and complete.

i authorize the City to discuss my

DO nOt discuss my

i declare, under penalty of perjury, that this return

claim and attachments with my

claim with my preparer.

is based on all information of which i have knowledge.

preparer

Filer’s Signature ______________________________________________ Date __________________

PREPaRER’S SignatuRE & aDDRESS

Birthdate ______________________________

Spouse’s Signature ____________________________________________ Date __________________

Birthdate ______________________________

Phone (

)_______________________________

Mail YOuR REtuRn FOR REFUND tO: CitY OF Big RaPiDS, inCOME taX DiViSiOn, 226 nORth MiChigan aVE., Big RaPiDS, Mi 49307

Mail YOuR REtuRn FOR PAYMENT tO: CitY OF Big RaPiDS, tREaSuRER’S OFFiCE, 226 nORth MiChigan aVE., Big RaPiDS, Mi 49307

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2