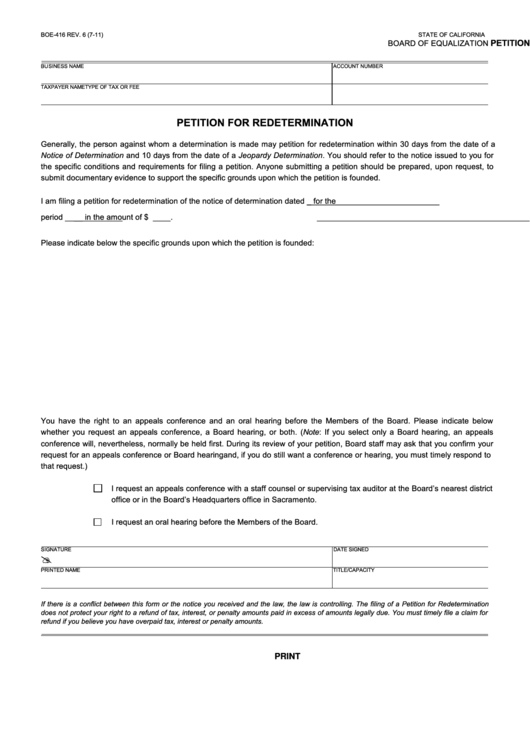

BOE-416 REV. 6 (7-11)

STATE OF CALIFORNIA

PETITION FOR REDETERMINATION

BOARD OF EQUALIZATION

BU SINESS NAME

ACCOUNT NUMBER

TAXPAYER NAME

TYPE OF TAX OR FEE

PETITION FOR REDETERMINATION

Generally, the person against whom a determination is made may petition for redetermination within 30 days from the date of a

Notice of Determination and 10 days from the date of a Jeopardy Determination. You should refer to the notice issued to you for

the specific conditions and requirements for filing a petition. Anyone submitting a petition should be prepared, upon request, to

submit documentary evidence to support the specific grounds upon which the petition is founded.

I am filing a petition for redetermination of the notice of determination dated _

______________________________

for the

period __

___________

_________________________

__ in the amount of $ __

_______________________________

__.

Please indicate below the specific grounds upon which the petition is founded:

You have the right to an appeals conference and an oral hearing before the Members of the Board. Please indicate below

whether you request an appeals conference, a Board hearing, or both. (Note: If you select only a Board hearing, an appeals

conference will, nevertheless, normally be held first. During its review of your petition, Board staff may ask that you confirm your

request for an appeals conference or Board hearing and, if you do still want a conference or hearing, you must timely respond to

that request.)

I request an appeals conference with a staff counsel or supervising tax auditor at the Board’s nearest district

office or in the Board’s Headquarters office in Sacramento.

I request an oral hearing before the Members of the Board.

SIGNATURE

DATE SIGNED

PRINTED NAME

TITLE/CAPACITY

If there is a conflict between this form or the notice you received and the law, the law is controlling. The filing of a Petition for Redetermination

does not protect your right to a refund of tax, interest, or penalty amounts paid in excess of amounts legally due. You must timely file a claim for

refund if you believe you have overpaid tax, interest or penalty amounts.

CLEAR

PRINT

1

1