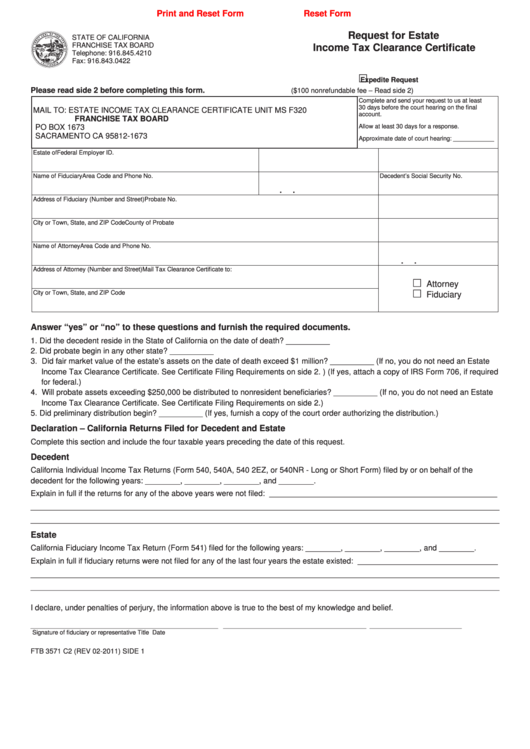

Print and Reset Form

Reset Form

Request for Estate

STATE OF CALIFORNIA

FRANCHISE TAX BOARD

Income Tax Clearance Certificate

Telephone: 916.845.4210

Fax: 916.843.0422

Expedite Request

Please read side 2 before completing this form.

($100 nonrefundable fee – Read side 2)

Complete and send your request to us at least

30 days before the court hearing on the final

MAIL TO:

ESTATE INCOME TAX CLEARANCE CERTIFICATE UNIT MS F320

account.

FRanChIsE Tax BoaRd

Allow at least 30 days for a response.

PO BOX 1673

SACRAMENTO CA 95812-1673

Approximate date of court hearing: ____________

Estate of

Federal Employer ID. No.

Date of Death

Name of Fiduciary

Area Code and Phone No.

Decedent’s Social Security No.

.

.

Address of Fiduciary (Number and Street)

Probate No.

City or Town, State, and ZIP Code

County of Probate

Name of Attorney

Area Code and Phone No.

.

.

Address of Attorney (Number and Street)

Mail Tax Clearance Certificate to:

Attorney

City or Town, State, and ZIP Code

Fiduciary

answer “yes” or “no” to these questions and furnish the required documents.

1. Did the decedent reside in the State of California on the date of death? __________

2. Did probate begin in any other state? __________

3. Did fair market value of the estate’s assets on the date of death exceed $1 million? __________ (If no, you do not need an Estate

Income Tax Clearance Certificate. See Certificate Filing Requirements on side 2. ) (If yes, attach a copy of IRS Form 706, if required

for federal.)

4. Will probate assets exceeding $250,000 be distributed to nonresident beneficiaries? __________ (If no, you do not need an Estate

Income Tax Clearance Certificate. See Certificate Filing Requirements on side 2.)

5. Did preliminary distribution begin? __________ (If yes, furnish a copy of the court order authorizing the distribution.)

declaration – California Returns Filed for decedent and Estate

Complete this section and include the four taxable years preceding the date of this request.

decedent

California Individual Income Tax Returns (Form 540, 540A, 540 2EZ, or 540NR - Long or Short Form) filed by or on behalf of the

decedent for the following years: ________, ________, ________, and ________.

Explain in full if the returns for any of the above years were not filed: ____________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

Estate

California Fiduciary Income Tax Return (Form 541) filed for the following years: ________, ________, ________, and ________.

Explain in full if fiduciary returns were not filed for any of the last four years the estate existed: ________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

I declare, under penalties of perjury, the information above is true to the best of my knowledge and belief.

_______________________________________________________

__________________________________________

___________________________

Signature of fiduciary or representative

Title

Date

FTB 3571 C2 (REV 02-2011) SIDE 1

1

1