Form Otr 40 - Questionnaire For Determining Responsibility For Corporate Taxes

ADVERTISEMENT

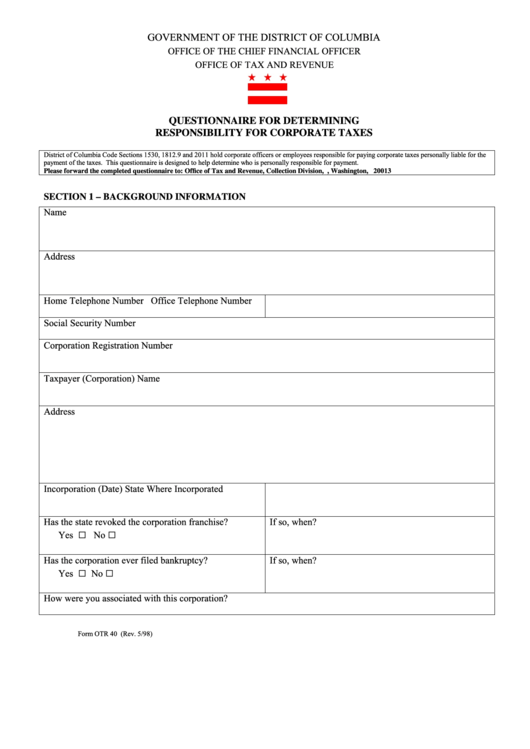

GOVERNMENT OF THE DISTRICT OF COLUMBIA

OFFICE OF THE CHIEF FINANCIAL OFFICER

OFFICE OF TAX AND REVENUE

QUESTIONNAIRE FOR DETERMINING

RESPONSIBILITY FOR CORPORATE TAXES

District of Columbia Code Sections 1530, 1812.9 and 2011 hold corporate officers or employees responsible for paying corporate taxes personally liable for the

payment of the taxes. This questionnaire is designed to help determine who is personally responsible for payment.

Please forward the completed questionnaire to: Office of Tax and Revenue, Collection Division, P.O. Box 37559, Washington, D.C. 20013

SECTION 1 – BACKGROUND INFORMATION

Name

Address

Home Telephone Number

Office Telephone Number

Social Security Number

Corporation Registration Number

Taxpayer (Corporation) Name

Address

Incorporation (Date)

State Where Incorporated

Has the state revoked the corporation franchise?

If so, when?

□

□

Yes

No

Has the corporation ever filed bankruptcy?

If so, when?

□

□

Yes

No

How were you associated with this corporation?

Form OTR 40 (Rev. 5/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4