Community Wind Power Generator Credit Worksheet For Tax Year 2006 Form

ADVERTISEMENT

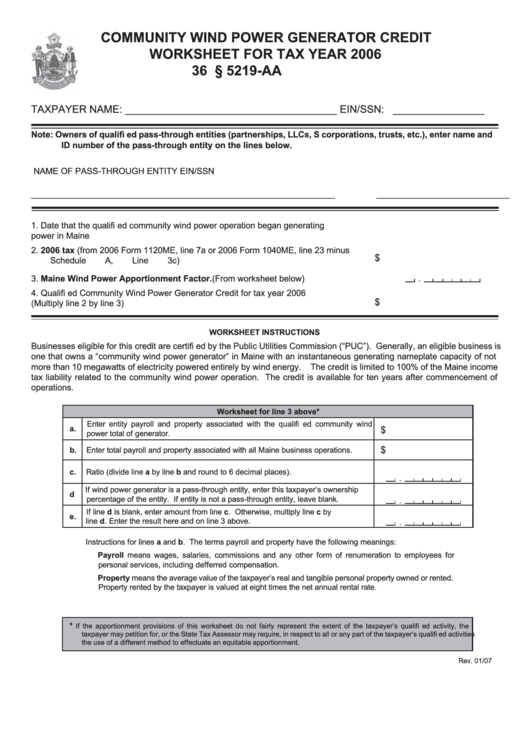

COMMUNITY WIND POWER GENERATOR CREDIT

WORKSHEET FOR TAX YEAR 2006

36 M.R.S.A. § 5219-AA

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of qualifi ed pass-through entities (partnerships, LLCs, S corporations, trusts, etc.), enter name and

ID number of the pass-through entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1.

Date that the qualifi ed community wind power operation began generating

power in Maine ........................................................................................................ 1. __________________________

2.

2006 tax (from 2006 Form 1120ME, line 7a or 2006 Form 1040ME, line 23 minus

$

Schedule A, Line 3c) ................................................................................................ 2. __________________________

3.

Maine Wind Power Apportionment Factor. (From worksheet below) ................. 3.

.

4.

Qualifi ed Community Wind Power Generator Credit for tax year 2006

$

(Multiply line 2 by line 3) .......................................................................................... 4. __________________________

WORKSHEET INSTRUCTIONS

Businesses eligible for this credit are certifi ed by the Public Utilities Commission (“PUC”). Generally, an eligible business is

one that owns a “community wind power generator” in Maine with an instantaneous generating nameplate capacity of not

more than 10 megawatts of electricity powered entirely by wind energy. The credit is limited to 100% of the Maine income

tax liability related to the community wind power operation. The credit is available for ten years after commencement of

operations.

Worksheet for line 3 above*

Enter entity payroll and property associated with the qualifi ed community wind

a.

$

power total of generator.

$

b.

Enter total payroll and property associated with all Maine business operations.

c.

Ratio (divide line a by line b and round to 6 decimal places).

.

If wind power generator is a pass-through entity, enter this taxpayer’s ownership

d

percentage of the entity. If entity is not a pass-through entity, leave blank.

.

If line d is blank, enter amount from line c. Otherwise, multiply line c by

e.

line d. Enter the result here and on line 3 above.

.

Instructions for lines a and b. The terms payroll and property have the following meanings:

Payroll means wages, salaries, commissions and any other form of renumeration to employees for

personal services, including defferred compensation.

Property means the average value of the taxpayer’s real and tangible personal property owned or rented.

Property rented by the taxpayer is valued at eight times the net annual rental rate.

*

If the apportionment provisions of this worksheet do not fairly represent the extent of the taxpayer’s qualifi ed activity, the

taxpayer may petition for, or the State Tax Assessor may require, in respect to all or any part of the taxpayer’s qualifi ed activities

the use of a different method to effectuate an equitable apportionment.

Rev. 01/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1