Form 106 Cr - Colorado Partnership - S Corporation Credit - 2004

ADVERTISEMENT

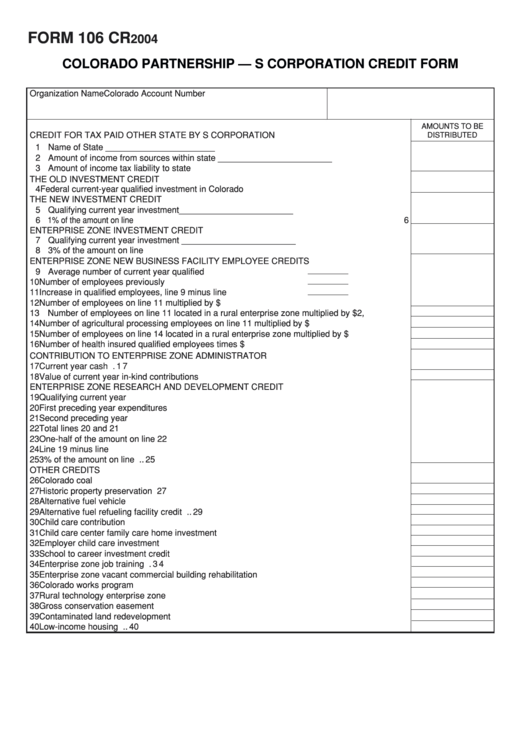

FORM 106 CR

2004

COLORADO PARTNERSHIP — S CORPORATION CREDIT FORM

Organization Name

Colorado Account Number

AMOUNTS TO BE

CREDIT FOR TAX PAID OTHER STATE BY S CORPORATION

DISTRIBUTED

1 Name of State _______________________

2 Amount of income from sources within state ________________________

3 Amount of income tax liability to state ....................................................................................... 3

THE OLD INVESTMENT CREDIT

4 Federal current-year qualified investment in Colorado assets .................................................. 4

THE NEW INVESTMENT CREDIT

5 Qualifying current year investment________________________

6 1% of the amount on line 5 ........................................................................................................................ 6

ENTERPRISE ZONE INVESTMENT CREDIT

7 Qualifying current year investment ________________________

8 3% of the amount on line 7 ........................................................................................................ 8

ENTERPRISE ZONE NEW BUSINESS FACILITY EMPLOYEE CREDITS

9 Average number of current year qualified employees .......................

10 Number of employees previously claimed .........................................

11 Increase in qualified employees, line 9 minus line 10 .......................

12 Number of employees on line 11 multiplied by $500 ............................................................... 12

13 Number of employees on line 11 located in a rural enterprise zone multiplied by $2,000 ...... 13

14 Number of agricultural processing employees on line 11 multiplied by $500 .......................... 14

15 Number of employees on line 14 located in a rural enterprise zone multiplied by $500 ......... 15

16 Number of health insured qualified employees times $200 ..................................................... 16

CONTRIBUTION TO ENTERPRISE ZONE ADMINISTRATOR

17 Current year cash contributions ............................................................................................... 17

18 Value of current year in-kind contributions .............................................................................. 18

ENTERPRISE ZONE RESEARCH AND DEVELOPMENT CREDIT

19 Qualifying current year expenditures .................................................. ____________________

20 First preceding year expenditures ...................................................... ____________________

21 Second preceding year expenditures ................................................. ____________________

22 Total lines 20 and 21 .......................................................................... ____________________

23 One-half of the amount on line 22 ...................................................... ____________________

24 Line 19 minus line 23 .......................................................................... ____________________

25 3% of the amount on line 24 .................................................................................................... 25

OTHER CREDITS

26 Colorado coal credit ................................................................................................................. 26

27 Historic property preservation credit ........................................................................................ 27

28 Alternative fuel vehicle credit ................................................................................................... 28

29 Alternative fuel refueling facility credit ..................................................................................... 29

30 Child care contribution credit ................................................................................................... 30

31 Child care center family care home investment credit ............................................................. 31

32 Employer child care investment credit ..................................................................................... 32

33 School to career investment credit .......................................................................................... 33

34 Enterprise zone job training credit ........................................................................................... 34

35 Enterprise zone vacant commercial building rehabilitation credit ............................................ 35

36 Colorado works program credit ............................................................................................... 36

37 Rural technology enterprise zone credit .................................................................................. 37

38 Gross conservation easement credit ....................................................................................... 38

39 Contaminated land redevelopment credit ................................................................................ 39

40 Low-income housing credit ...................................................................................................... 40

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1