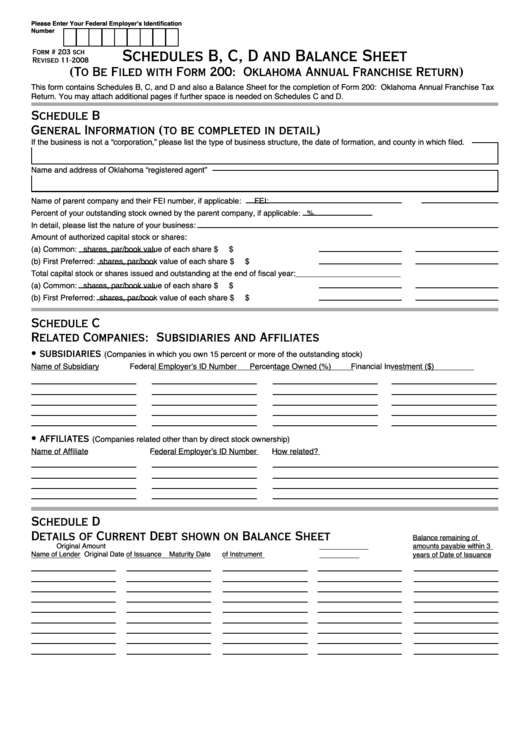

Please Enter Your Federal Employer’s Identification

Number

Here...

Schedules B, C, D and Balance Sheet

Form # 203 sch

Revised 11-2008

(To Be Filed with Form 200: Oklahoma Annual Franchise Return)

This form contains Schedules B, C, and D and also a Balance Sheet for the completion of Form 200: Oklahoma Annual Franchise Tax

Return. You may attach additional pages if further space is needed on Schedules C and D.

Schedule B

General Information (to be completed in detail)

If the business is not a “corporation,” please list the type of business structure, the date of formation, and county in which filed.

Name and address of Oklahoma “registered agent”

Name of parent company and their FEI number, if applicable:

FEI:

Percent of your outstanding stock owned by the parent company, if applicable:

%

In detail, please list the nature of your business:

Amount of authorized capital stock or shares:

(a) Common:

shares, par/book value of each share

$

$

(b) First Preferred:

shares, par/book value of each share

$

$

Total capital stock or shares issued and outstanding at the end of fiscal year: ________________________

(a) Common:

shares, par/book value of each share

$

$

(b) First Preferred:

shares, par/book value of each share

$

$

Schedule C

Related Companies: Subsidiaries and Affiliates

• subsidiaries

(Companies in which you own 15 percent or more of the outstanding stock)

Name of Subsidiary

Federal Employer’s ID Number

Percentage Owned (%)

Financial Investment ($)

• affiliates

(Companies related other than by direct stock ownership)

Name of Affiliate

Federal Employer’s ID Number

How related?

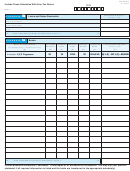

Schedule D

Details of Current Debt shown on Balance Sheet

Balance remaining of

Original Amount

amounts payable within 3

Name of Lender

Original Date of Issuance

Maturity Date

of Instrument

years of Date of Issuance

1

1 2

2