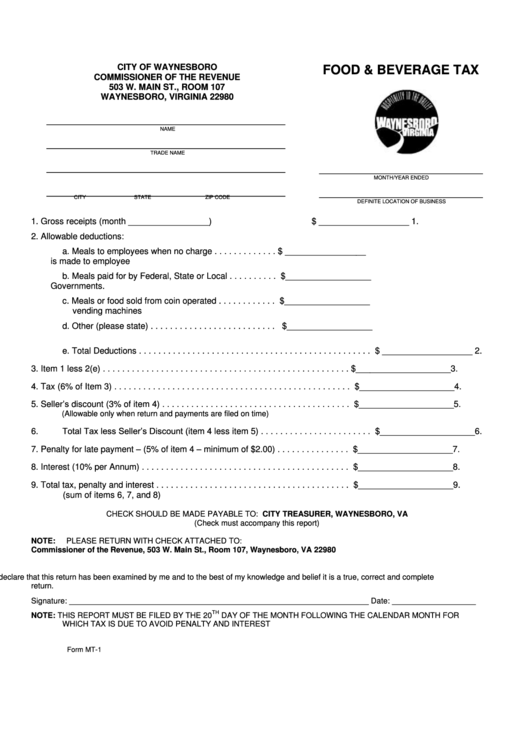

Form Mt-1 - Food & Beverage Tax Form - City Of Waynesboro Commissioner Of The Revenue

ADVERTISEMENT

CITY OF WAYNESBORO

FOOD & BEVERAGE TAX

COMMISSIONER OF THE REVENUE

503 W. MAIN ST., ROOM 107

WAYNESBORO, VIRGINIA 22980

___________________________________

NAME

___________________________________

TRADE NAME

___________________________________

________________________

P.O. BOX OR MAILING ADDRESS

MONTH/YEAR ENDED

___________________________________

________________________

CITY

STATE

ZIP CODE

DEFINITE LOCATION OF BUSINESS

1.

Gross receipts (month _________________)

$ ___________________ 1.

2.

Allowable deductions:

a. Meals to employees when no charge . . . . . . . . . . . . . $ _________________

is made to employee

b. Meals paid for by Federal, State or Local . . . . . . . . . . $__________________

Governments.

c. Meals or food sold from coin operated . . . . . . . . . . . . $__________________

vending machines

d. Other (please state) . . . . . . . . . . . . . . . . . . . . . . . . . . $__________________

e. Total Deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ___________________ 2.

3.

Item 1 less 2(e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $____________________3.

4.

Tax (6% of Item 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $____________________4.

5.

Seller’s discount (3% of item 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $____________________5.

(Allowable only when return and payments are filed on time)

Total Tax less Seller’s Discount (item 4 less item 5) . . . . . . . . . . . . . . . . . . . . . . . $____________________6.

6.

Penalty for late payment – (5% of item 4 – minimum of $2.00) . . . . . . . . . . . . . . . $____________________7.

7.

8.

Interest (10% per Annum) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $____________________8.

9.

Total tax, penalty and interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $____________________9.

(sum of items 6, 7, and 8)

CHECK SHOULD BE MADE PAYABLE TO: CITY TREASURER, WAYNESBORO, VA

(Check must accompany this report)

NOTE:

PLEASE RETURN WITH CHECK ATTACHED TO:

Commissioner of the Revenue, 503 W. Main St., Room 107, Waynesboro, VA 22980

I declare that this return has been examined by me and to the best of my knowledge and belief it is a true, correct and complete

return.

Signature: ____________________________________________________________________

Date: ___________________

TH

NOTE: THIS REPORT MUST BE FILED BY THE 20

DAY OF THE MONTH FOLLOWING THE CALENDAR MONTH FOR

WHICH TAX IS DUE TO AVOID PENALTY AND INTEREST

Form MT-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1