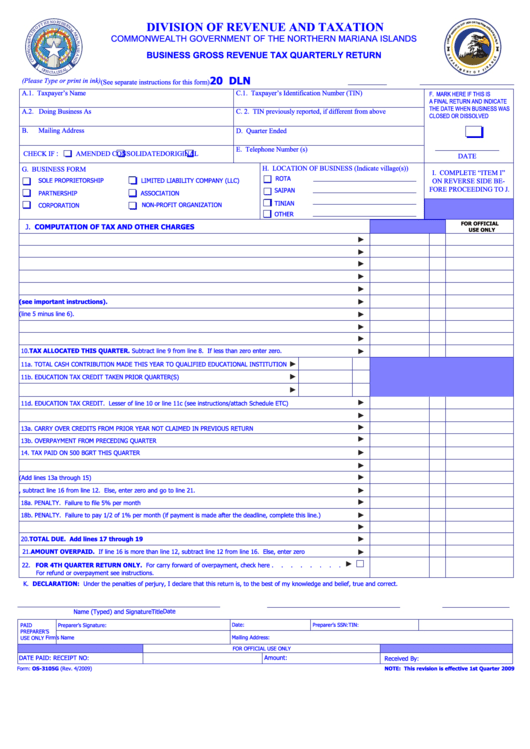

DIVISION OF REVENUE AND TAXATION

COMMONWEALTH GOVERNMENT OF THE NORTHERN MARIANA ISLANDS

BUSINESS GROSS REVENUE TAX QUARTERLY RETURN

20

DLN

(Please Type or print in ink)

(See separate instructions for this form)

A.1. Taxpayer’s Name

C.1. Taxpayer’s Identification Number (TIN)

F. MARK HERE IF THIS IS

A FINAL RETURN AND INDICATE

THE DATE WHEN BUSINESS WAS

A.2. Doing Business As

C. 2. TIN previously reported, if different from above

CLOSED OR DISSOLVED

B.

Mailing Address

D. Quarter Ended

E. Telephone Number (s)

:

CHECK IF

AMENDED

CONSOLIDATED

ORIGINAL

DATE

H. LOCATION OF BUSINESS (Indicate village(s))

G. BUSINESS FORM

I. COMPLETE “ITEM I”

ROTA

SOLE PROPRIETORSHIP

ON REVERSE SIDE BE-

LIMITED LIABILITY COMPANY (LLC)

FORE PROCEEDING TO J.

SAIPAN

PARTNERSHIP

ASSOCIATION

TINIAN

NON-PROFIT ORGANIZATION

CORPORATION

OTHER

FOR OFFICIAL

J. COMPUTATION OF TAX AND OTHER CHARGES

USE ONLY

1. TOTAL REVENUE FOR THE PERIOD JANUARY 1 - MARCH 31.

2. TOTAL REVENUE FOR THE PERIOD APRIL 1 - JUNE 30.

3. TOTAL REVENUE FOR THE PERIOD JULY 1 - SEPTEMBER 30.

4. TOTAL REVENUE FOR THE PERIOD OCTOBER 1 - DECEMBER 31.

5. ADD LINES 1 TRHU 4.

6. LESS REVENUE NOT SUBJECT TO TAX (see important instructions).

7. GROSS REVENUE SUBJECT TO TAX (line 5 minus line 6).

8. TAX ON AMOUNT SHOWN ON LINE 7.

9. TAX ALLOCATED PREVIOUS QUARTER.

10. TAX ALLOCATED THIS QUARTER. Subtract line 9 from line 8. If less than zero enter zero.

11a. TOTAL CASH CONTRIBUTION MADE THIS YEAR TO QUALIFIED EDUCATIONAL INSTITUTION

11b. EDUCATION TAX CREDIT TAKEN PRIOR QUARTER(S)

11c. EDUCATION TAX CREDIT AVAILABLE THIS QUARTER. Line 11a minus 11b

11d. EDUCATION TAX CREDIT. Lesser of line 10 or line 11c (see instructions/attach Schedule ETC)

12. TAX BEFORE PAYMENT CREDIT. SUBTRACT LINE 11d FROM LINE 10.

13a. CARRY OVER CREDITS FROM PRIOR YEAR NOT CLAIMED IN PREVIOUS RETURN

13b. OVERPAYMENT FROM PRECEDING QUARTER

14. TAX PAID ON 500 BGRT THIS QUARTER

15. TAX PAID ON ORIGINAL OR AMENDED RETURN FOR THIS QUARTER

16. TOTAL CREDIT THIS QUARTER. (Add lines 13a through 15)

17. TAX DUE. If line 12 is more than line 16, subtract line 16 from line 12. Else, enter zero and go to line 21.

18a. PENALTY. Failure to file 5% per month

18b. PENALTY. Failure to pay 1/2 of 1% per month (if payment is made after the deadline, complete this line.)

19. INTEREST

20. TOTAL DUE. Add lines 17 through 19

21. AMOUNT OVERPAID. If line 16 is more than line 12, subtract line 12 from line 16. Else, enter zero

22. FOR 4TH QUARTER RETURN ONLY. For carry forward of overpayment, check here .

.

.

.

.

.

.

.

For refund or overpayment see instructions.

K. DECLARATION: Under the penalties of perjury, I declare that this return is, to the best of my knowledge and belief, true and correct.

Date

Name (Typed) and Signature

Title

Date:

Preparer’s SSN:

PAID

Preparer’s Signature:

TIN:

PREPARER’S

Firm’s Name

USE ONLY

Mailing Address:

FOR OFFICIAL USE ONLY

RECEIPT NO:

Amount:

DATE PAID:

Received By:

Form: OS-3105G (Rev. 4/2009)

NOTE: This revision is effective 1st Quarter 2009

1

1 2

2 3

3 4

4