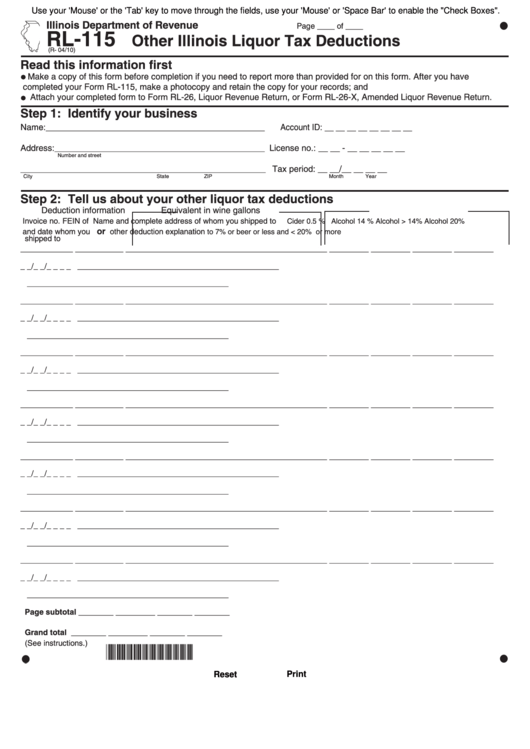

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

Page ____ of ____

RL-115

Other Illinois Liquor Tax Deductions

(R- 04/10)

Read this information first

Make a copy of this form before completion if you need to report more than provided for on this form. After you have

completed your Form RL-115, make a photocopy and retain the copy for your records; and

Attach your completed form to Form RL-26, Liquor Revenue Return, or Form RL-26-X, Amended Liquor Revenue Return.

Step 1: Identify your business

Name:

Account ID: __ __ __ __ __ __ __ __

__________________________________________________

Address:

License no.: __ __ - __ __ __ __ __

________________________________________________

Number and street

Tax period: __ __/__ __ __ __

________________________________________________________

City

State

ZIP

Month

Year

Step 2: Tell us about your other liquor tax deductions

Deduction information

Equivalent in wine gallons

Invoice no.

FEIN of

Name and complete address of whom you shipped to

Cider 0.5 % Alcohol 14 % Alcohol > 14% Alcohol 20%

or

and date

whom you

other deduction explanation

to 7% or beer

or less

and < 20%

or more

shipped to

____________ ___________ ______________________________________________ _________ _________ _________ _________

_ _/_ _/_ _ _ _

______________________________________________

______________________________________________

____________ ___________ ______________________________________________ _________ _________ _________ _________

_ _/_ _/_ _ _ _

______________________________________________

______________________________________________

____________ ___________ ______________________________________________ _________ _________ _________ _________

_ _/_ _/_ _ _ _

______________________________________________

______________________________________________

____________ ___________ ______________________________________________ _________ _________ _________ _________

_ _/_ _/_ _ _ _

______________________________________________

______________________________________________

____________ ___________ ______________________________________________ _________ _________ _________ _________

_ _/_ _/_ _ _ _

______________________________________________

______________________________________________

____________ ___________ ______________________________________________ _________ _________ _________ _________

_ _/_ _/_ _ _ _

______________________________________________

______________________________________________

____________ ___________ ______________________________________________ _________ _________ _________ _________

_ _/_ _/_ _ _ _

______________________________________________

______________________________________________

Page subtotal

________

_________

________

________

Grand total

________

_________

________

________

(See instructions.)

*036311110*

Reset

Print

1

1 2

2