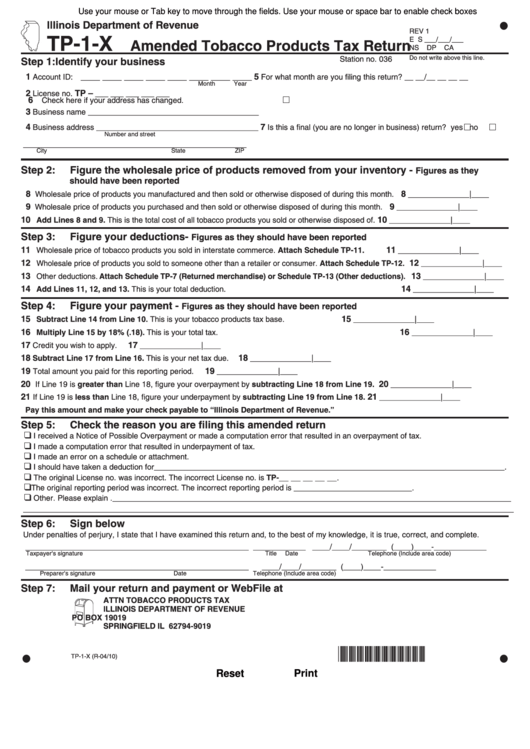

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

REV 1

TP-1-X

E S ___/___/___

Amended Tobacco Products Tax Return

NS DP CA

Do not write above this line.

Station no. 036

Step 1:

Identify your business

1

5

Account ID: ____ ____ ____ ____ ____ ____ ____ ____

For what month are you filing this return?

__ __/__ __ __ __

Month Year

2

TP –

License no.

___ ___ ___ ___ ___

6

Check here if your address has changed.

3

Business name _______________________________________

4

7

Business address _____________________________________

Is this a final (you are no longer in business) return? yes no

Number and street

___________________________________________________

City State ZIP

Step 2:

Figure the wholesale price of products removed from your inventory -

Figures as they

should have been reported

8

8

W holesale price of products you manufactured and then sold or otherwise disposed of during this month.

______________|____

9

9

W holesale price of products you purchased and then sold or otherwise disposed of during this month.

______________|____

10

10

Add Lines 8 and 9. This is the total cost of all tobacco products you sold or otherwise disposed of.

______________|____

Step 3:

Figure your deductions-

Figures as they should have been reported

11

11

Wholesale price of tobacco products you sold in interstate commerce. Attach Schedule TP-11.

______________|____

12

12

Wholesale price of products you sold to someone other than a retailer or consumer. Attach Schedule TP-12.

______________|____

13

13

Other deductions. Attach Schedule TP-7 (Returned merchandise) or Schedule TP-13 (Other deductions).

______________|____

14

14

Add Lines 11, 12, and 13. This is your total deduction.

______________|____

Step 4:

Figure your payment -

Figures as they should have been reported

15

15

Subtract Line 14 from Line 10. This is your tobacco products tax base.

______________|____

16

16

Multiply Line 15 by 18% (.18). This is your total tax.

______________|____

17

17

Credit you wish to apply.

______________|____

18

18

Subtract Line 17 from Line 16. This is your net tax due.

______________|____

19

19

Total amount you paid for this reporting period.

______________|____

20

20

If Line 19 is greater than Line 18, figure your overpayment by subtracting Line 18 from Line 19.

______________|____

21

21

If Line 19 is less than Line 18, figure your underpayment by subtracting Line 19 from Line 18.

______________|____

P ay this amount and make your check payable to “Illinois Department of Revenue.”

Step 5:

Check the reason you are filing this amended return

❑

I received a Notice of Possible Overpayment or made a computation error that resulted in an overpayment of tax.

❑

I made a computation error that resulted in underpayment of tax.

❑

I made an error on a schedule or attachment.

❑

I should have taken a deduction for________________________________________________________________________________.

❑

The original License no. was incorrect. The incorrect License no. is TP-__ __ __ __ __.

❑

The original reporting period was incorrect. The incorrect reporting period is ___________________________.

❑

Other. Please explain .___________________________________________________________________________________________

________________________________________________________________________________________________________________

Step 6:

Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

___________________________________________________

____________ ____/____/________ (____)____-____________

Taxpayer's signature Title

Date Telephone (Include area code)

___________________________________________________

____/____/________ (____)____-____________

Preparer's signature

Date Telephone (Include area code)

Step 7:

Mail your return and payment or WebFile at tax.illinois.gov

ATTN TOBACCO PRODUCTS TAX

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19019

SPRINGFIELD IL 62794-9019

*040111110*

TP-1-X (R-04/10)

Print

Reset

1

1 2

2