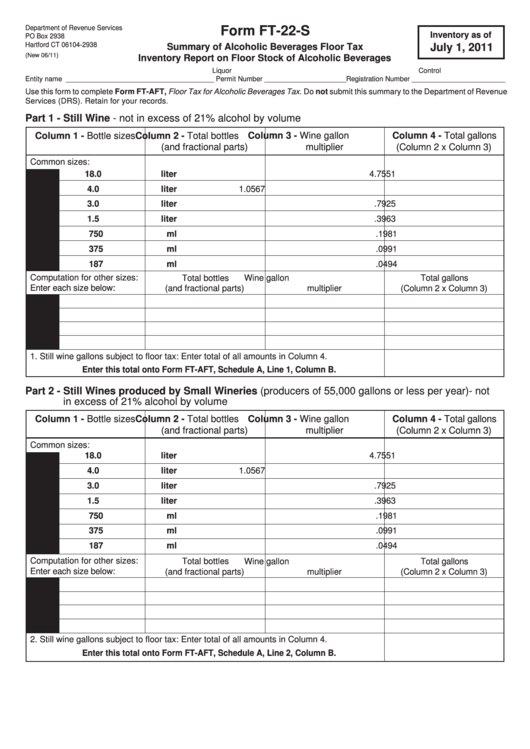

Form Ft-22-S - Summary Of Alcoholic Beverages Floor Tax Inventory Report On Floor Stock Of Alcoholic Beverages

ADVERTISEMENT

Department of Revenue Services

Form FT-22-S

Inventory as of

PO Box 2938

Hartford CT 06104-2938

Summary of Alcoholic Beverages Floor Tax

July 1, 2011

(New 06/11)

Inventory Report on Floor Stock of Alcoholic Beverages

Liquor Control

Connecticut Tax

Entity name ______________________________________ Permit Number _____________________ Registration Number ________________________

Use this form to complete Form FT-AFT, Floor Tax for Alcoholic Beverages Tax. Do not submit this summary to the Department of Revenue

Services (DRS). Retain for your records.

Part 1 - Still Wine - not in excess of 21% alcohol by volume

Column 1 - Bottle sizes

Column 2 - Total bottles

Column 3 - Wine gallon

Column 4 - Total gallons

(and fractional parts)

multiplier

(Column 2 x Column 3)

Common sizes:

18.0 liter

4.7551

4.0 liter

1.0567

3.0 liter

.7925

1.5 liter

.3963

750 ml

.1981

375 ml

.0991

187 ml

.0494

Computation for other sizes:

Total bottles

Wine gallon

Total gallons

Enter each size below:

(and fractional parts)

multiplier

(Column 2 x Column 3)

1. Still wine gallons subject to fl oor tax: Enter total of all amounts in Column 4. ................ 1.

Enter this total onto Form FT-AFT, Schedule A, Line 1, Column B.

Part 2 - Still Wines produced by Small Wineries (producers of 55,000 gallons or less per year) - not

in excess of 21% alcohol by volume

Column 1 - Bottle sizes

Column 2 - Total bottles

Column 3 - Wine gallon

Column 4 - Total gallons

(and fractional parts)

multiplier

(Column 2 x Column 3)

Common sizes:

18.0 liter

4.7551

4.0 liter

1.0567

3.0 liter

.7925

1.5 liter

.3963

750 ml

.1981

375 ml

.0991

187 ml

.0494

Computation for other sizes:

Total bottles

Wine gallon

Total gallons

Enter each size below:

(and fractional parts)

multiplier

(Column 2 x Column 3)

2. Still wine gallons subject to fl oor tax: Enter total of all amounts in Column 4. ................ 2.

Enter this total onto Form FT-AFT, Schedule A, Line 2, Column B.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4