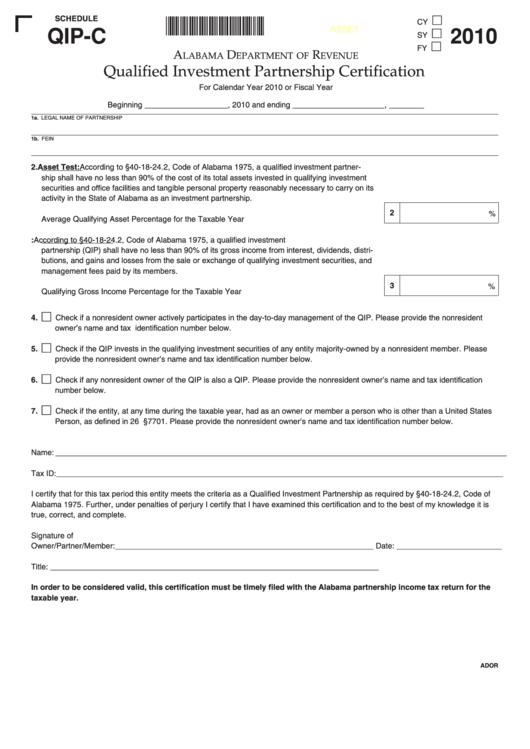

SCHEDULE

100006QP

CY

QIP-C

2010

RESET

SY

FY

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Qualified Investment Partnership Certification

For Calendar Year 2010 or Fiscal Year

Beginning ___________________, 2010 and ending _____________________, ________

1a. LEGAL NAME OF PARTNERSHIP

1b. FEIN

2. Asset Test: According to §40-18-24.2, Code of Alabama 1975, a qualified investment partner-

ship shall have no less than 90% of the cost of its total assets invested in qualifying investment

securities and office facilities and tangible personal property reasonably necessary to carry on its

activity in the State of Alabama as an investment partnership.

2

%

Average Qualifying Asset Percentage for the Taxable Year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Gross Income Test: According to §40-18-24.2, Code of Alabama 1975, a qualified investment

partnership (QIP) shall have no less than 90% of its gross income from interest, dividends, distri-

butions, and gains and losses from the sale or exchange of qualifying investment securities, and

management fees paid by its members.

3

%

Qualifying Gross Income Percentage for the Taxable Year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

Check if a nonresident owner actively participates in the day-to-day management of the QIP. Please provide the nonresident

owner’s name and tax identification number below.

5.

Check if the QIP invests in the qualifying investment securities of any entity majority-owned by a nonresident member. Please

provide the nonresident owner’s name and tax identification number below.

6.

Check if any nonresident owner of the QIP is also a QIP. Please provide the nonresident owner’s name and tax identification

number below.

7.

Check if the entity, at any time during the taxable year, had as an owner or member a person who is other than a United States

Person, as defined in 26 U.S.C. §7701. Please provide the nonresident owner’s name and tax identification number below.

Name: _______________________________________________________________________________________________________

Tax ID: ______________________________________________________________________________________________________

I certify that for this tax period this entity meets the criteria as a Qualified Investment Partnership as required by §40-18-24.2, Code of

Alabama 1975. Further, under penalties of perjury I certify that I have examined this certification and to the best of my knowledge it is

true, correct, and complete.

Signature of

Owner/Partner/Member: ___________________________________________________________ Date: ________________________

Title: ___________________________________________________________________________

In order to be considered valid, this certification must be timely filed with the Alabama partnership income tax return for the

taxable year.

ADOR

1

1 2

2