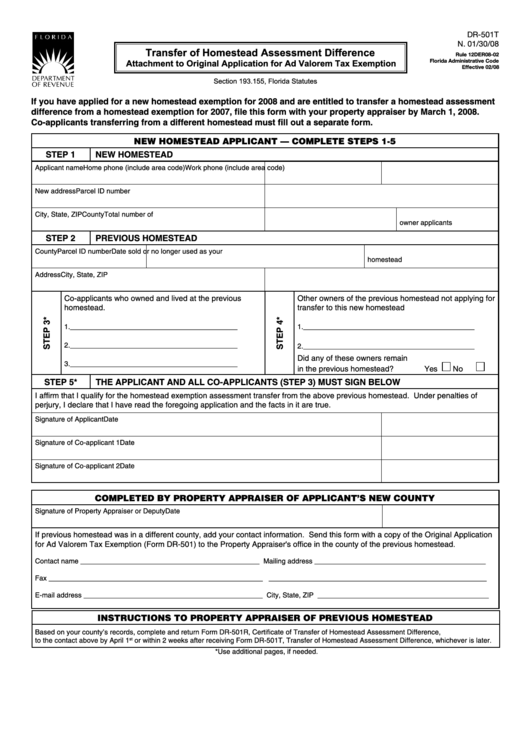

DR-501T

N. 01/30/08

Transfer of Homestead Assessment Difference

Rule 12DER08-02

Florida Administrative Code

Attachment to Original Application for Ad Valorem Tax Exemption

Effective 02/08

Section 193.155, Florida Statutes

If you have applied for a new homestead exemption for 2008 and are entitled to transfer a homestead assessment

difference from a homestead exemption for 2007, file this form with your property appraiser by March 1, 2008.

Co-applicants transferring from a different homestead must fill out a separate form.

NEW HOMESTEAD APPLICANT — COMPLETE STEPS 1-5

STEP 1

NEW HOMESTEAD

Applicant name

Home phone (include area code)

Work phone (include area code)

New address

Parcel ID number

City, State, ZIP

County

Total number of

owner applicants

STEP 2

PREVIOUS HOMESTEAD

County

Parcel ID number

Date sold or no longer used as your

homestead

Address

City, State, ZIP

Co-applicants who owned and lived at the previous

Other owners of the previous homestead not applying for

homestead.

transfer to this new homestead

1.___________________________________________

1.____________________________________________

2.___________________________________________

2.____________________________________________

Did any of these owners remain

3.___________________________________________

in the previous homestead?

Yes

No

STEP 5*

THE APPlICANT AND All CO-APPlICANTS (STEP 3) MUST SIgN bElOW

I affirm that I qualify for the homestead exemption assessment transfer from the above previous homestead. Under penalties of

perjury, I declare that I have read the foregoing application and the facts in it are true.

Signature of Applicant

Date

Signature of Co-applicant 1

Date

Signature of Co-applicant 2

Date

COMPLETED BY PROPERTY APPRAISER OF APPLICANT’S NEW COUNTY

Signature of Property Appraiser or Deputy

Date

If previous homestead was in a different county, add your contact information. Send this form with a copy of the Original Application

for Ad Valorem Tax Exemption (Form DR-501) to the Property Appraiser's office in the county of the previous homestead.

Contact name ______________________________________________

Mailing address ____________________________________________

Fax_______________________________________________________

________________________________________________________

E-mail address______________________________________________

City, State, ZIP ____________________________________________

INSTRUCTIONS TO PROPERTY APPRAISER OF PREVIOUS HOMESTEAD

Based on your county’s records, complete and return Form DR-501R, Certificate of Transfer of Homestead Assessment Difference,

to the contact above by April 1

or within 2 weeks after receiving Form DR-501T, Transfer of Homestead Assessment Difference, whichever is later.

st

*Use additional pages, if needed.

1

1