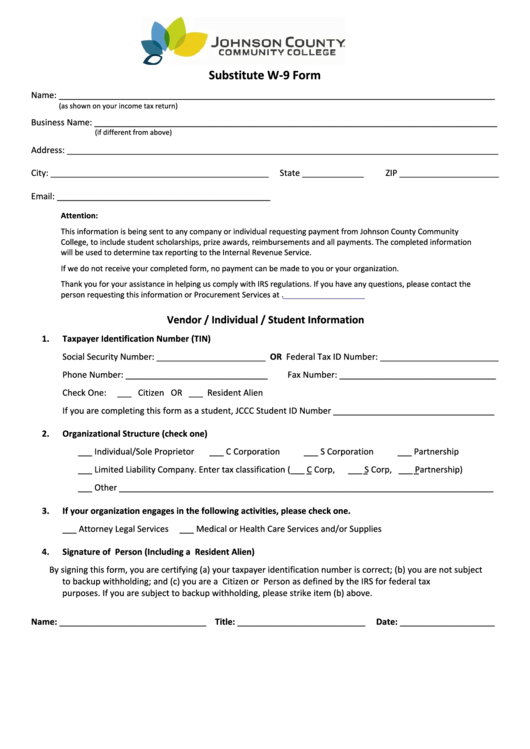

Substitute W‐9 Form

Name: ____________________________________________________________________________________________

(as shown on your income tax return)

Business Name: _____________________________________________________________________________________

(if different from above)

Address: ___________________________________________________________________________________________

City: ______________________________________________ State _____________ ZIP _____________________

Email: _____________________________________________

Attention:

This information is being sent to any company or individual requesting payment from Johnson County Community

College, to include student scholarships, prize awards, reimbursements and all payments. The completed information

will be used to determine tax reporting to the Internal Revenue Service.

If we do not receive your completed form, no payment can be made to you or your organization.

Thank you for your assistance in helping us comply with IRS regulations. If you have any questions, please contact the

person requesting this information or Procurement Services at procurement@jccc.edu.

Vendor / Individual / Student Information

1.

Taxpayer Identification Number (TIN)

Social Security Number: _______________________ OR Federal Tax ID Number: _________________________

Phone Number: ______________________________ Fax Number: _________________________________

Check One: ___ U.S. Citizen OR ___ Resident Alien

If you are completing this form as a student, JCCC Student ID Number __________________________________

2.

Organizational Structure (check one)

___ Individual/Sole Proprietor ___ C Corporation ___ S Corporation ___ Partnership

___ Limited Liability Company. Enter tax classification (___ C Corp, ___ S Corp, ___ Partnership)

___ Other _______________________________________________________________________________

3.

If your organization engages in the following activities, please check one.

___ Attorney Legal Services ___ Medical or Health Care Services and/or Supplies

4.

Signature of U.S. Person (Including a U.S. Resident Alien)

By signing this form, you are certifying (a) your taxpayer identification number is correct; (b) you are not subject

to backup withholding; and (c) you are a U.S. Citizen or U.S. Person as defined by the IRS for federal tax

purposes. If you are subject to backup withholding, please strike item (b) above.

Name: _______________________________ Title: ___________________________ Date: ____________________

CLEAR FORM

1

1