Reset Form

Michigan Department of Treasury

4226 (11-04)

Affidavit Filed by a Qualified Start-Up Business for

Claiming Property Tax Exemption

Issued under P.A. 252 of 2004 and P.A. 324 of 2004. Filing is voluntary.

INSTRUCTIONS: Read instructions on Page 2 of this form before completing this application. File this form and the

required attachments with the assessor of the local tax collecting unit.

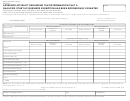

PART 1: IDENTIFICATION OF APPLICANT AND PROPERTY

1. Applicant/Company Name (Applicant must be a Qualified Start-Up Business)

2. County

Company Mailing Address (No. and Street, P.O. Box, City, State, ZIP Code)

3. City/Township/Village (Circle one and provide its name)

Location of Qualified Start-Up Business (No. and Street, City, State, ZIP Code)

4. Local School District

5. Exemption is being claimed for:

Real Property

Personal Property

If you checked Real Property, attach the legal description.

6. Name of Person in the Qualified Start-Up Business to contact for further information 7. Telephone Number

8. Mailing Address

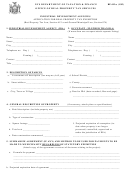

PART 2: TYPES OF EXEMPTION COVERED BY THIS APPLICATION. Check the box(es) that apply.

Exemption from part of the tax levied on the regular ad valorem assessment roll as authorized by P.A. 252 of 2004.

Exemption from part of the tax levied on lessees or uses of tax-exempt properties assessed on that part of the

regular ad valorem roll set aside for properties assessed under the provisions of P.A. 189 of 1953 (MCL 211.181 to

211.182). This exemption is authorized by P.A. 324 of 2004.

Exemption from part of the specific tax levied upon property already exempt from taxation on the regular assessment

roll under the provisions of the Obsolete Property Rehabilitation Act, P.A. 146 of 2000 (MCL 125.2781 et seq.). This

exemption from the specific tax is authorized by P.A. 251 of 2004.

Exemption from part of the specific tax levied upon property already exempt from taxation on the regular assessment

roll under the provisions of the Technology Park Development Act, P.A. 385 of 1985 (MCL 207.701 et seq.). This

exemption from the specific tax is authorized by P.A. 321 of 2004.

Exemption from part of the specific tax levied upon property already exempt from taxation on the regular assessment

roll under the provisions of P.A. 198 of 1974 (sometimes known as the Industrial Facilities Tax Act) (MCL 207.551 et

seq.). This exemption from the specified tax is authorized by P.A. 323 of 2004.

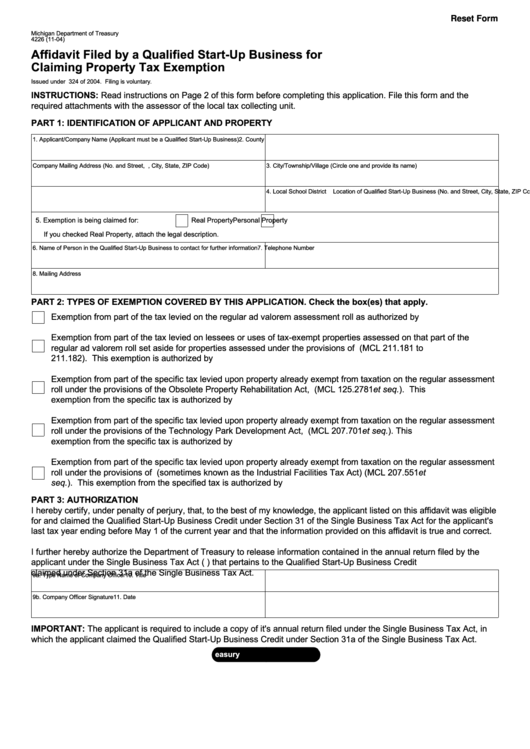

PART 3: AUTHORIZATION

I hereby certify, under penalty of perjury, that, to the best of my knowledge, the applicant listed on this affidavit was eligible

for and claimed the Qualified Start-Up Business Credit under Section 31 of the Single Business Tax Act for the applicant's

last tax year ending before May 1 of the current year and that the information provided on this affidavit is true and correct.

I further hereby authorize the Department of Treasury to release information contained in the annual return filed by the

applicant under the Single Business Tax Act (P.A. 228 of 1975) that pertains to the Qualified Start-Up Business Credit

claimed under Section 31a of the Single Business Tax Act.

9a. Type Name of Company Officer

10. Title

9b. Company Officer Signature

11. Date

IMPORTANT: The applicant is required to include a copy of it's annual return filed under the Single Business Tax Act, in

which the applicant claimed the Qualified Start-Up Business Credit under Section 31a of the Single Business Tax Act.

1

1 2

2