Application For Sales Tax Registration Only For Use By Sole-Proprietorship Owners With No Employees Form

ADVERTISEMENT

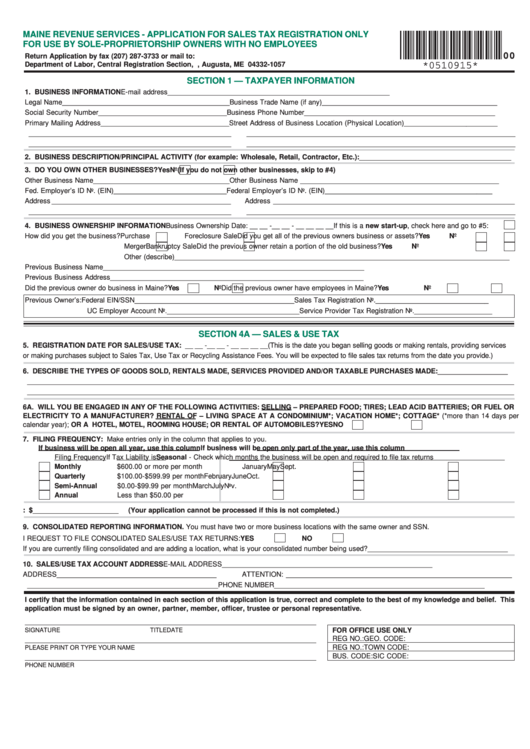

MAINE REVENUE SERVICES - APPLICATION FOR SALES TAX REGISTRATION ONLY

FOR USE BY SOLE-PROPRIETORSHIP OWNERS WITH NO EMPLOYEES

00

Return Application by fax (207) 287-3733 or mail to:

*0510915*

Department of Labor, Central Registration Section, P.O. Box 1057, Augusta, ME 04332-1057

SECTION 1 — TAXPAYER INFORMATION

1. BUSINESS INFORMATION

E-mail address _________________________________________________________

Legal Name ___________________________________________

Business Trade Name (if any) _____________________________________________

Social Security Number _________________________________

Business Phone Number _________________________________________________

Primary Mailing Address _________________________________

Street Address of Business Location (Physical Location) ________________________

____________________________________________________

_____________________________________________________________________

____________________________________________________

_____________________________________________________________________

2. BUSINESS DESCRIPTION/PRINCIPAL ACTIVITY (for example: Wholesale, Retail, Contractor, Etc.): _______________________________________

3. DO YOU OWN OTHER BUSINESSES? Yes

No

(If you do not own other businesses, skip to #4)

Other Business Name ___________________________________

Other Business Name ___________________________________________________

Fed. Employer’s ID No. (EIN) _____________________________

Federal Employer’s ID No. (EIN) ___________________________________________

Address ______________________________________________

Address ______________________________________________________________

____________________________________________________

_____________________________________________________________________

4. BUSINESS OWNERSHIP INFORMATION

Business Ownership Date: __ __ -__ __ - __ __ __ __ If this is a new start-up, check here and go to #5:

How did you get the business? Purchase

Foreclosure Sale

Did you get all of the previous owners business or assets? Yes

No

Merger

Bankruptcy Sale

Did the previous owner retain a portion of the old business? Yes

No

Other (describe) ______________________________________________________________________________________

Previous Business Name ___________________________________________________________________

Previous Business Address _________________________________________________________________

Did the previous owner do business in Maine? Yes

No

Did the previous owner have employees in Maine?

Yes

No

Previous Owner’s: Federal EIN/SSN _________________________________________

Sales Tax Registration No. _____________________________

UC Employer Account No. __________________________________

Service Provider Tax Registration No. ____________________

SECTION 4A — SALES & USE TAX

5. REGISTRATION DATE FOR SALES/USE TAX: __ __ -__ __ - __ __ __ __ (This is the date you began selling goods or making rentals, providing services

or making purchases subject to Sales Tax, Use Tax or Recycling Assistance Fees. You will be expected to file sales tax returns from the date you provide.)

6. DESCRIBE THE TYPES OF GOODS SOLD, RENTALS MADE, SERVICES PROVIDED AND/OR TAXABLE PURCHASES MADE: __________________

_____________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________

6A. WILL YOU BE ENGAGED IN ANY OF THE FOLLOWING ACTIVITIES: SELLING – PREPARED FOOD; TIRES; LEAD ACID BATTERIES; OR FUEL OR

ELECTRICITY TO A MANUFACTURER? RENTAL OF – LIVING SPACE AT A CONDOMINIUM*; VACATION HOME*; COTTAGE* (*more than 14 days per

calendar year); OR A HOTEL, MOTEL, ROOMING HOUSE; OR RENTAL OF AUTOMOBILES?

YES

NO

7. FILING FREQUENCY: Make entries only in the column that applies to you.

If business will be open all year, use this column

If business will be open only part of the year, use this column

Filing Frequency

If Tax Liability is

Seasonal - Check which months the business will be open and required to file tax returns

Monthly

$600.00 or more per month

January

May

Sept.

Quarterly

$100.00-$599.99 per month

February

June

Oct.

Semi-Annual

$0.00-$99.99 per month

March

July

Nov.

Annual

Less than $50.00 per year

April

Aug.

Dec.

8. ESTIMATED GROSS ANNUAL SALES: $ ______________________

(Your application cannot be processed if this is not completed.)

9. CONSOLIDATED REPORTING INFORMATION. You must have two or more business locations with the same owner and SSN.

I REQUEST TO FILE CONSOLIDATED SALES/USE TAX RETURNS:

YES

NO

If you are currently filing consolidated and are adding a location, what is your consolidated number being used? ____________________________________

10. SALES/USE TAX ACCOUNT ADDRESS

E-MAIL ADDRESS ______________________________________________________

ADDRESS _________________________________________

ATTENTION: __________________________________________________________

_________________________________________________

PHONE NUMBER ______________________________________________________

I certify that the information contained in each section of this application is true, correct and complete to the best of my knowledge and belief. This

application must be signed by an owner, partner, member, officer, trustee or personal representative.

FOR OFFICE USE ONLY

SIGNATURE

TITLE

DATE

REG NO.:

GEO. CODE:

REG NO.:

TOWN CODE:

PLEASE PRINT OR TYPE YOUR NAME

BUS. CODE:

SIC CODE:

PHONE NUMBER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2