Reset Form

Print Form

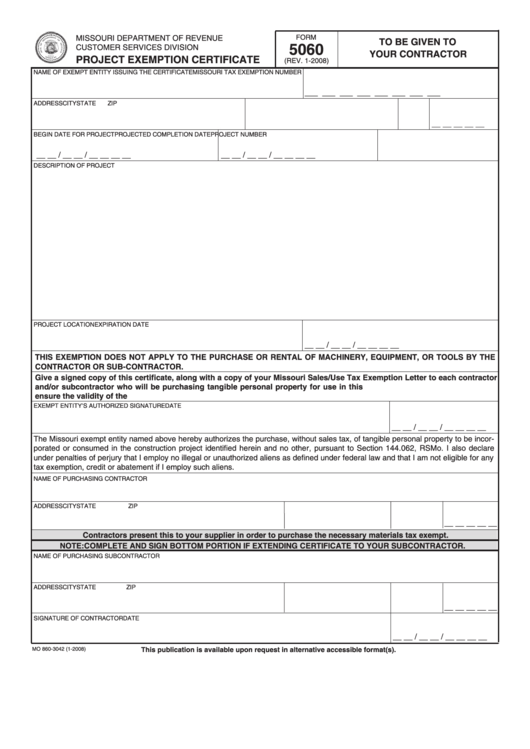

MISSOURI DEPARTMENT OF REVENUE

FORM

TO BE GIVEN TO

5060

CUSTOMER SERVICES DIVISION

YOUR CONTRACTOR

PROJECT EXEMPTION CERTIFICATE

(REV. 1-2008)

NAME OF EXEMPT ENTITY ISSUING THE CERTIFICATE

MISSOURI TAX EXEMPTION NUMBER

___ ___ ___ ___ ___ ___ ___ ___

ADDRESS

CITY

STATE

ZIP

__ __ __ __ __

BEGIN DATE FOR PROJECT

PROJECTED COMPLETION DATE

PROJECT NUMBER

__ __ / __ __ / __ __ __ __

__ __ / __ __ / __ __ __ __

DESCRIPTION OF PROJECT

PROJECT LOCATION

EXPIRATION DATE

__ __ / __ __ / __ __ __ __

THIS EXEMPTION DOES NOT APPLY TO THE PURCHASE OR RENTAL OF MACHINERY, EQUIPMENT, OR TOOLS BY THE

CONTRACTOR OR SUB-CONTRACTOR.

Give a signed copy of this certificate, along with a copy of your Missouri Sales/Use Tax Exemption Letter to each contractor

and/or subcontractor who will be purchasing tangible personal property for use in this project. It is your responsibility to

ensure the validity of the certificate. You must issue a new certificate if any of the information changes.

EXEMPT ENTITY’S AUTHORIZED SIGNATURE

DATE

__ __ / __ __ / __ __ __ __

The Missouri exempt entity named above hereby authorizes the purchase, without sales tax, of tangible personal property to be incor-

porated or consumed in the construction project identified herein and no other, pursuant to Section 144.062, RSMo. I also declare

under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any

tax exemption, credit or abatement if I employ such aliens.

NAME OF PURCHASING CONTRACTOR

ADDRESS

CITY

STATE

ZIP

__ __ __ __ __

Contractors present this to your supplier in order to purchase the necessary materials tax exempt.

NOTE: COMPLETE AND SIGN BOTTOM PORTION IF EXTENDING CERTIFICATE TO YOUR SUBCONTRACTOR.

NAME OF PURCHASING SUBCONTRACTOR

ADDRESS

CITY

STATE

ZIP

__ __ __ __ __

SIGNATURE OF CONTRACTOR

DATE

__ __ / __ __ / __ __ __ __

MO 860-3042 (1-2008)

This publication is available upon request in alternative accessible format(s).

1

1