Business And Professional Questionnaire Form - City Of Massillon

ADVERTISEMENT

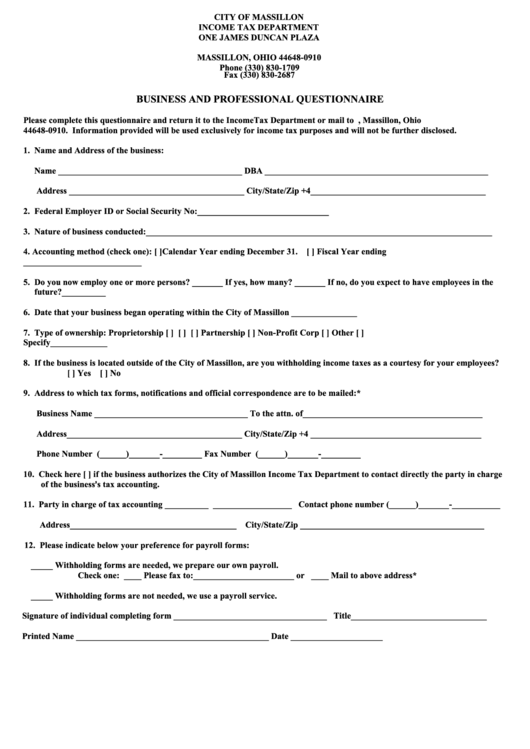

CITY OF MASSILLON

INCOME TAX DEPARTMENT

ONE JAMES DUNCAN PLAZA

P.O. BOX 910

MASSILLON, OHIO 44648-0910

Phone (330) 830-1709

Fax (330) 830-2687

BUSINESS AND PROFESSIONAL QUESTIONNAIRE

Please complete this questionnaire and return it to the Income Tax Department or mail to P.O. Box 910, Massillon, Ohio

44648-0910. Information provided will be used exclusively for income tax purposes and will not be further disclosed.

1. Name and Address of the business:

Name __________________________________________ DBA ___________________________________________________

Address ________________________________________ City/State/Zip +4________________________________________

2. Federal Employer ID or Social Security No:______________________________

3. Nature of business conducted:_______________________________________________________________________________

4. Accounting method (check one): [ ]Calendar Year ending December 31. [ ] Fiscal Year ending

___________________________

5. Do you now employ one or more persons? _______ If yes, how many? _______ If no, do you expect to have employees in the

future?__________

6. Date that your business began operating within the City of Massillon _______________

7. Type of ownership: Proprietorship [ ] S.Corp [ ] C.Corp [ ] Partnership [ ] Non-Profit Corp [ ] Other [ ]

Specify_____________

8. If the business is located outside of the City of Massillon, are you withholding income taxes as a courtesy for your employees?

[ ] Yes [ ] No

9. Address to which tax forms, notifications and official correspondence are to be mailed:*

Business Name ___________________________________ To the attn. of_________________________________________

Address________________________________________ City/State/Zip +4 _______________________________________

Phone Number (______)_______-_________ Fax Number (______)_______-_________

10. Check here [ ] if the business authorizes the City of Massillon Income Tax Department to contact directly the party in charge

of the business=s tax accounting.

11. Party in charge of tax accounting __________ __________________ Contact phone number (______)_______-___________

Address______________________________________ City/State/Zip __________________________________________

12. Please indicate below your preference for payroll forms:

_____ Withholding forms are needed, we prepare our own payroll.

Check one: ____ Please fax to:_______________________ or ____ Mail to above address*

_____ Withholding forms are not needed, we use a payroll service.

Signature of individual completing form ___________________________________ Title_______________________________

Printed Name ____________________________________________ Date _____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2