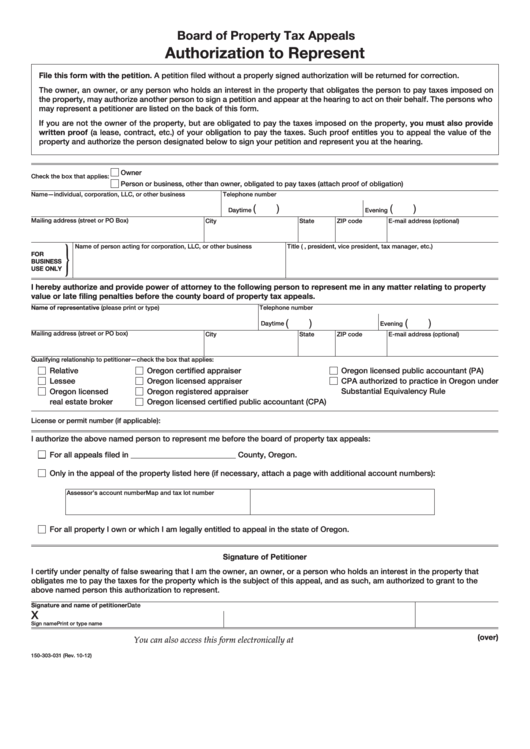

Board of Property Tax Appeals

Clear Form

Authorization to Represent

File this form with the petition. A petition filed without a properly signed authorization will be returned for correction.

The owner, an owner, or any person who holds an interest in the property that obligates the person to pay taxes imposed on

the property, may authorize another person to sign a petition and appear at the hearing to act on their behalf. The persons who

may represent a petitioner are listed on the back of this form.

If you are not the owner of the property, but are obligated to pay the taxes imposed on the property, you must also provide

written proof (a lease, contract, etc.) of your obligation to pay the taxes. Such proof entitles you to appeal the value of the

property and authorize the person designated below to sign your petition and represent you at the hearing.

Owner

Check the box that applies:

Person or business, other than owner, obligated to pay taxes (attach proof of obligation)

Name—individual, corporation, LLC, or other business

Telephone number

(

)

(

)

Daytime

Evening

Mailing address (street or PO Box)

City

State

ZIP code

E-mail address (optional)

}

Name of person acting for corporation, LLC, or other business

Title (i.e., president, vice president, tax manager, etc.)

FOR

BUSINESS

USE ONLY

I hereby authorize and provide power of attorney to the following person to represent me in any matter relating to property

value or late filing penalties before the county board of property tax appeals.

Name of representative (please print or type)

Telephone number

(

)

(

)

Daytime

Evening

Mailing address (street or PO box)

City

State

ZIP code

E-mail address (optional)

Qualifying relationship to petitioner—check the box that applies:

Relative

Oregon certified appraiser

Oregon licensed public accountant (PA)

Lessee

Oregon licensed appraiser

CPA authorized to practice in Oregon under

Oregon licensed

Oregon registered appraiser

Substantial Equivalency Rule

real estate broker

Oregon licensed certified public accountant (CPA)

License or permit number (if applicable):

I authorize the above named person to represent me before the board of property tax appeals:

For all appeals filed in ___________________________ County, Oregon.

Only in the appeal of the property listed here (if necessary, attach a page with additional account numbers):

Assessor’s account number

Map and tax lot number

For all property I own or which I am legally entitled to appeal in the state of Oregon.

Signature of Petitioner

I certify under penalty of false swearing that I am the owner, an owner, or a person who holds an interest in the property that

obligates me to pay the taxes for the property which is the subject of this appeal, and as such, am authorized to grant to the

above named person this authorization to represent.

Signature and name of petitioner

Date

X

Sign name

Print or type name

(over)

You can also access this form electronically at

150-303-031 (Rev. 10-12)

1

1