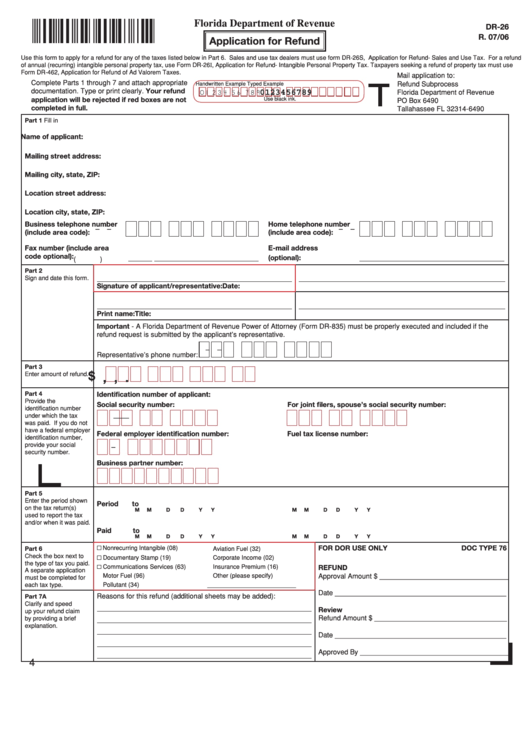

Florida Department of Revenue

DR-26

R. 07/06

Application for Refund

Use this form to apply for a refund for any of the taxes listed below in Part 6. Sales and use tax dealers must use form DR-�6S, Application for Refund- Sales and Use Tax. For a refund

of annual (recurring) intangible personal property tax, use Form DR-�6I, Application for Refund- Intangible Personal Property Tax. Taxpayers seeking a refund of property tax must use

Form DR-46�, Application for Refund of Ad Valorem Taxes.

Mail application to:

Complete Parts 1 through 7 and attach appropriate

Refund Subprocess

Handwritten Example

Typed Example

documentation. Type or print clearly. Your refund

0123456789

Florida Department of Revenue

0 1 2 3 4 5 6 7 8 9

application will be rejected if red boxes are not

Use black ink.

PO Box 6490

completed in full.

Tallahassee FL 3�314-6490

Part 1 Fill in

Name of applicant:

Mailing street address:

Mailing city, state, ZIP:

Location street address:

Location city, state, ZIP:

Business telephone number

Home telephone number

–

–

–

–

(include area code):

(include area code):

Fax number (include area

E-mail address

code optional):

(optional):

(

)

Part 2

Sign and date this form.

Signature of applicant/representative:

Date:

Print name:

Title:

Important - A Florida Department of Revenue Power of Attorney (Form DR-835) must be properly executed and included if the

refund request is submitted by the applicant’s representative.

–

–

Representative’s phone number:

Part 3

$

Enter amount of refund.

,

,

.

Identification number of applicant:

Part 4

Provide the

Social security number:

For joint filers, spouse’s social security number:

identification number

under which the tax

–

–

–

–

was paid. If you do not

have a federal employer

Federal employer identification number:

Fuel tax license number:

identification number,

provide your social

–

security number.

Business partner number:

Part 5

Enter the period shown

Period

to

on the tax return(s)

M

M

D

D

Y

Y

M

M

D

D

Y

Y

used to report the tax

and/or when it was paid.

Paid

to

M

M

D

D

Y

Y

M

M

D

D

Y

Y

FOR DOR USE ONLY

DOC TYPE 76

Nonrecurring Intangible (08)

Part 6

Aviation Fuel (3�)

Check the box next to

Documentary Stamp (19)

Corporate Income (0�)

the type of tax you paid.

Communications Services (63)

Insurance Premium (16)

REFUND

A separate application

Motor Fuel (96)

Other (please specify)

Approval Amount $ _________________________________

must be completed for

Pollutant (34)

__________________________

each tax type.

Date ____________________________________________

Reasons for this refund (additional sheets may be added):

Part 7A

Clarify and speed

Review

up your refund claim

Refund Amount $ __________________________________

by providing a brief

explanation.

Date ____________________________________________

Approved By ______________________________________

4

1

1 2

2 3

3