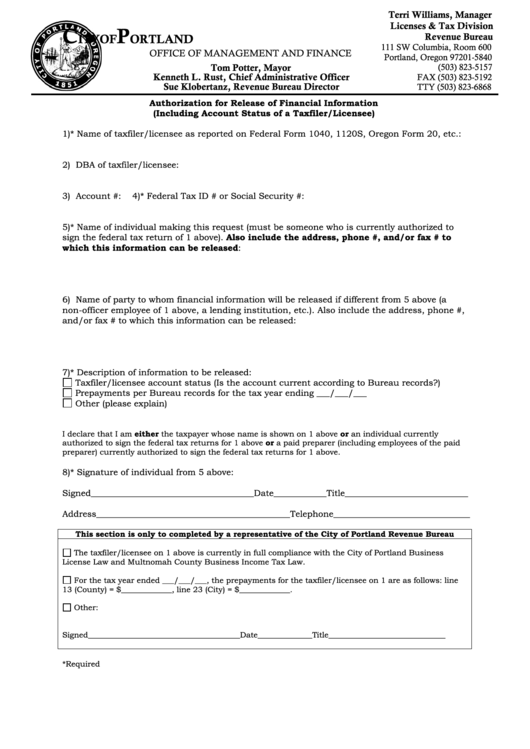

Authorization For Release Of Financial Information (Including Account Status Of A Taxfiler/licensee) Form - Portland

ADVERTISEMENT

Terri Williams, Manager

Licenses & Tax Division

C

P

Revenue Bureau

ITY OF

ORTLAND

111 SW Columbia, Room 600

OFFICE OF MANAGEMENT AND FINANCE

Portland, Oregon 97201-5840

(503) 823-5157

Tom Potter, Mayor

FAX (503) 823-5192

Kenneth L. Rust, Chief Administrative Officer

TTY (503) 823-6868

Sue Klobertanz, Revenue Bureau Director

Authorization for Release of Financial Information

(Including Account Status of a Taxfiler/Licensee)

1)* Name of taxfiler/licensee as reported on Federal Form 1040, 1120S, Oregon Form 20, etc.:

2) DBA of taxfiler/licensee:

3) Account #:

4)* Federal Tax ID # or Social Security #:

5)* Name of individual making this request (must be someone who is currently authorized to

sign the federal tax return of 1 above). Also include the address, phone #, and/or fax # to

which this information can be released:

6) Name of party to whom financial information will be released if different from 5 above (a

non-officer employee of 1 above, a lending institution, etc.). Also include the address, phone #,

and/or fax # to which this information can be released:

7)* Description of information to be released:

Taxfiler/licensee account status (Is the account current according to Bureau records?)

Prepayments per Bureau records for the tax year ending ___/___/___

Other (please explain)

I declare that I am either the taxpayer whose name is shown on 1 above or an individual currently

authorized to sign the federal tax returns for 1 above or a paid preparer (including employees of the paid

preparer) currently authorized to sign the federal tax returns for 1 above.

8)* Signature of individual from 5 above:

Signed_____________________________________Date____________Title____________________________

Address____________________________________________Telephone_______________________________

This section is only to completed by a representative of the City of Portland Revenue Bureau

The taxfiler/licensee on 1 above is currently in full compliance with the City of Portland Business

License Law and Multnomah County Business Income Tax Law.

For the tax year ended ___/___/___, the prepayments for the taxfiler/licensee on 1 are as follows: line

13 (County) = $_____________, line 23 (City) = $_____________.

Other:

Signed_______________________________________Date______________Title______________________________

*Required

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1