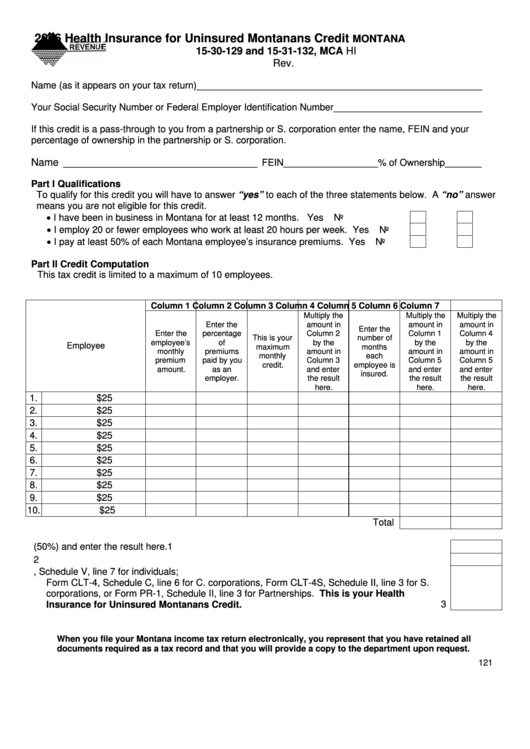

2006 Health Insurance for Uninsured Montanans Credit

MONTANA

15-30-129 and 15-31-132, MCA

HI

Rev. 12-06

__________________________________________________

Name (as it appears on your tax return)

__________________________

Your Social Security Number or Federal Employer Identification Number

If this credit is a pass-through to you from a partnership or S. corporation enter the name, FEIN and your

percentage of ownership in the partnership or S. corporation.

Name __________________________________

FEIN__________________ % of Ownership _______

Part I Qualifications

To qualify for this credit you will have to answer “yes” to each of the three statements below. A “no” answer

means you are not eligible for this credit.

•

.......................

I have been in business in Montana for at least 12 months.

Yes

No

•

.......

I employ 20 or fewer employees who work at least 20 hours per week.

Yes

No

•

........

I pay at least 50% of each Montana employee’s insurance premiums.

Yes

No

Part II Credit Computation

This tax credit is limited to a maximum of 10 employees.

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

Multiply the

Multiply the

Multiply the

Enter the

amount in

amount in

amount in

Enter the

Enter the

percentage

Column 2

Column 1

Column 4

This is your

number of

employee’s

of

by the

by the

by the

Employee

maximum

months

monthly

amount in

amount in

amount in

premiums

monthly

each

premium

paid by you

Column 3

Column 5

Column 5

credit.

employee is

amount.

as an

and enter

and enter

and enter

insured.

employer.

the result

the result

the result

here.

here.

here.

1.

$25

2.

$25

3.

$25

4.

$25

5.

$25

6.

$25

7.

$25

8.

$25

9.

$25

10.

$25

Total

..................................

1. Multiply the total of column 6 by .50 (50%) and enter the result here.

1

......................................................................................

2. Enter the total of column 7 here.

2

3. Enter the smaller of line 1 or line 2 here and on Form 2, Schedule V, line 7 for individuals;

Form CLT-4, Schedule C, line 6 for C. corporations, Form CLT-4S, Schedule II, line 3 for S.

corporations, or Form PR-1, Schedule II, line 3 for Partnerships. This is your Health

.................................................................

Insurance for Uninsured Montanans Credit.

3

When you file your Montana income tax return electronically, you represent that you have retained all

documents required as a tax record and that you will provide a copy to the department upon request.

121

1

1