Business And Occupation Tax Return Form

ADVERTISEMENT

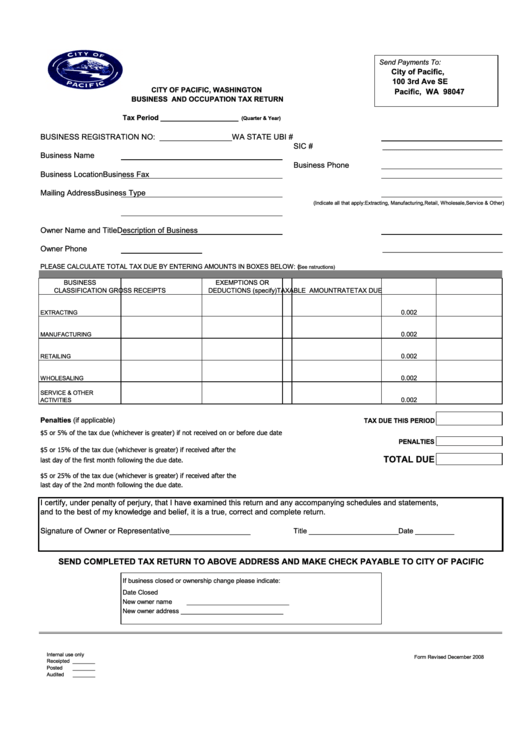

Send Payments To:

City of Pacific,

100 3rd Ave SE

CITY OF PACIFIC, WASHINGTON

Pacific, WA 98047

BUSINESS AND OCCUPATION TAX RETURN

Tax Period ____________________

(Quarter & Year)

BUSINESS REGISTRATION NO: _________________

WA STATE UBI #

SIC #

__________________________________

Business Name

Business Phone

Business Location

Business Fax

Mailing Address

Business Type

(Indicate all that apply:Extracting, Manufacturing,Retail, Wholesale,Service & Other)

Owner Name and Title

Description of Business

Owner Phone

__________________________________

PLEASE CALCULATE TOTAL TAX DUE BY ENTERING AMOUNTS IN BOXES BELOW: (

See nstructions)

BUSINESS

EXEMPTIONS OR

CLASSIFICATION

GROSS RECEIPTS

DEDUCTIONS (specify)

TAXABLE AMOUNT

RATE

TAX DUE

EXTRACTING

0.002

0.002

MANUFACTURING

0.002

RETAILING

0.002

WHOLESALING

SERVICE & OTHER

0.002

ACTIVITIES

Penalties (if applicable)

TAX DUE THIS PERIOD

$5 or 5% of the tax due (whichever is greater) if not received on or before due date

PENALTIES

$5 or 15% of the tax due (whichever is greater) if received after the

TOTAL DUE

last day of the first month following the due date.

$5 or 25% of the tax due (whichever is greater) if received after the

last day of the 2nd month following the due date.

I certify, under penalty of perjury, that I have examined this return and any accompanying schedules and statements,

and to the best of my knowledge and belief, it is a true, correct and complete return.

Signature of Owner or Representative___________________

Title _______________________

Date __________

SEND COMPLETED TAX RETURN TO ABOVE ADDRESS AND MAKE CHECK PAYABLE TO CITY OF PACIFIC

If business closed or ownership change please indicate:

Date Closed

New owner name

_____________________________

New owner address _____________________________

Internal use only

Form Revised December 2008

Receipted ________

Posted

________

Audited

________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1