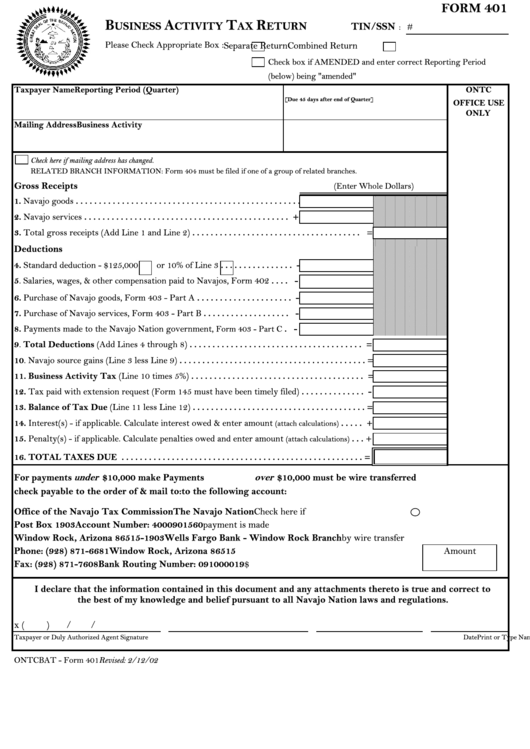

Form 401 - Business Activity Tax Return Navajo Nation

ADVERTISEMENT

401

FORM

B

A

T

R

USINESS

CTIVITY

AX

ETURN

TIN/SSN

: #

Please Check Appropriate Box :

Separate Return

Combined Return

Check box if AMENDED and enter correct Reporting Period

(below) being "amended"

Taxpayer Name

Reporting Period (Quarter)

ONTC

[Due 45 days after end of Quarter]

OFFICE USE

ONLY

Mailing Address

Business Activity

Check here if mailing address has changed.

RELATED BRANCH INFORMATION: Form 404 must be filed if one of a group of related branches.

Gross Receipts

(Enter Whole Dollars)

1. Navajo goods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Navajo services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . +

3. Total gross receipts (Add Line 1 and Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . =

Deductions

4. Standard deduction - $125,000

or 10% of Line 3 . . . . . . . . . . . . . . . . -

5. Salaries, wages, & other compensation paid to Navajos, Form 402 . . . . -

6. Purchase of Navajo goods, Form 403 - Part A . . . . . . . . . . . . . . . . . . . . . -

7. Purchase of Navajo services, Form 403 - Part B . . . . . . . . . . . . . . . . . . . -

8. Payments made to the Navajo Nation government,

. -

Form 403 - Part C

9. Total Deductions (Add Lines 4 through 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . =

10. Navajo source gains (Line 3 less Line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . =

11. Business Activity Tax (Line 10 times 5%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . =

12. Tax paid with extension request (Form 145 must have been timely filed) . . . . . . . . . . . . . . -

13. Balance of Tax Due (Line 11 less Line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . =

14. Interest(s) - if applicable. Calculate interest owed & enter amount

. . . . . +

(attach calculations)

15. Penalty(s) - if applicable. Calculate penalties owed and enter amount

. . . +

(attach calculations)

16. TOTAL TAXES DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . =

For payments

under $10,000 make

Payments

over $10,000 must be wire transferred

check payable to the order of & mail to:

to the following account:

Office of the Navajo Tax Commission

The Navajo Nation

Check here if

Post Box 1903

Account Number: 4000901560

payment is made

Window Rock, Arizona 86515-1903

Wells Fargo Bank - Window Rock Branch

by wire transfer

Phone: (928) 871-6681

Window Rock, Arizona 86515

Amount

Fax: (928) 871-7608

Bank Routing Number: 091000019

$

I declare that the information contained in this document and any attachments thereto is true and correct to

the best of my knowledge and belief pursuant to all Navajo Nation laws and regulations.

x

(

)

/

/

Taxpayer or Duly Authorized Agent Signature

Print or Type Name

Telephone Number

Date

ONTC

BAT - Form 401

Revised: 2/12/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1