Form Sw-3q - Reconciliation Of Stow Income Tax Withheld From Wages

ADVERTISEMENT

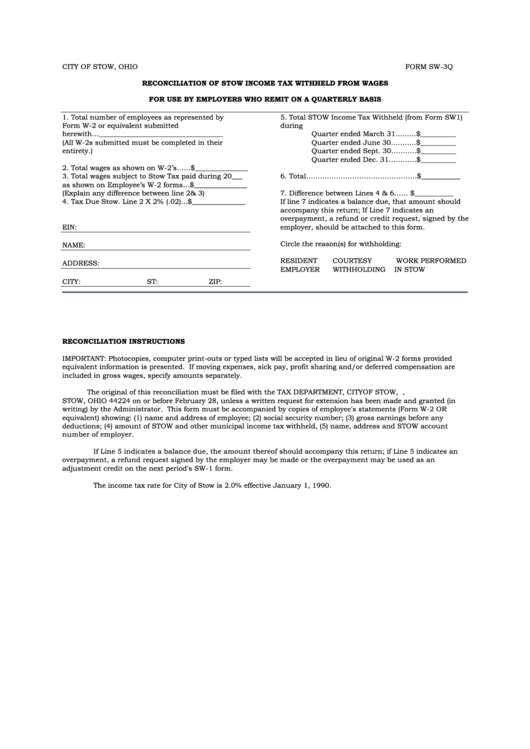

CITY OF STOW, OHIO

FORM SW-3Q

RECONCILIATION OF STOW INCOME TAX WITHHELD FROM WAGES

FOR USE BY EMPLOYERS WHO REMIT ON A QUARTERLY BASIS

1. Total number of employees as represented by

5. Total STOW Income Tax Withheld (from Form SW1)

Form W-2 or equivalent submitted

during

herewith…___________________________________

Quarter ended March 31………$__________

(All W-2s submitted must be completed in their

Quarter ended June 30………..$__________

entirety.)

Quarter ended Sept. 30………..$__________

Quarter ended Dec. 31…………$__________

2. Total wages as shown on W-2’s……$_______________

3. Total wages subject to Stow Tax paid during 20___

6. Total…………………………………………$___________

as shown on Employee’s W-2 forms…$_______________

(Explain any difference between line 2& 3)

7. Difference between Lines 4 & 6……....$___________

4. Tax Due Stow. Line 2 X 2% (.02)...$_______________

If line 7 indicates a balance due, that amount should

accompany this return; If Line 7 indicates an

overpayment, a refund or credit request, signed by the

EIN:

employer, should be attached to this form.

Circle the reason(s) for withholding:

NAME:

RESIDENT

COURTESY

WORK PERFORMED

ADDRESS:

EMPLOYER

WITHHOLDING

IN STOW

CITY:

ST:

ZIP:

RECONCILIATION INSTRUCTIONS

IMPORTANT: Photocopies, computer print-outs or typed lists will be accepted in lieu of original W-2 forms provided

equivalent information is presented. If moving expenses, sick pay, profit sharing and/or deferred compensation are

included in gross wages, specify amounts separately.

The original of this reconciliation must be filed with the TAX DEPARTMENT, CITY OF STOW, P.O. BOX 1668,

STOW, OHIO 44224 on or before February 28, unless a written request for extension has been made and granted (in

writing) by the Administrator. This form must be accompanied by copies of employee's statements (Form W-2 OR

equivalent) showing: (1) name and address of employee; (2) social security number; (3) gross earnings before any

deductions; (4) amount of STOW and other municipal income tax withheld, (5) name, address and STOW account

number of employer.

If Line 5 indicates a balance due, the amount thereof should accompany this return; if Line 5 indicates an

overpayment, a refund request signed by the employer may be made or the overpayment may be used as an

adjustment credit on the next period's SW-1 form.

The income tax rate for City of Stow is 2.0% effective January 1, 1990.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1