TOB: TS01

9/10

A

D

R

For Office Use Only

LABAMA

EPARTMENT OF

EVENUE

EFT: _____________________

S

, U

& B

T

D

ALES

SE

USINESS

AX

IVISION

Order Received By: __________

T

T

S

OBACCO

AX

ECTION

Date Received: _____________

P. O. Box 327555 • Montgomery, AL 36132-7555 • (334) 242-9627

Processed By: ______________

Date Processed: ____________

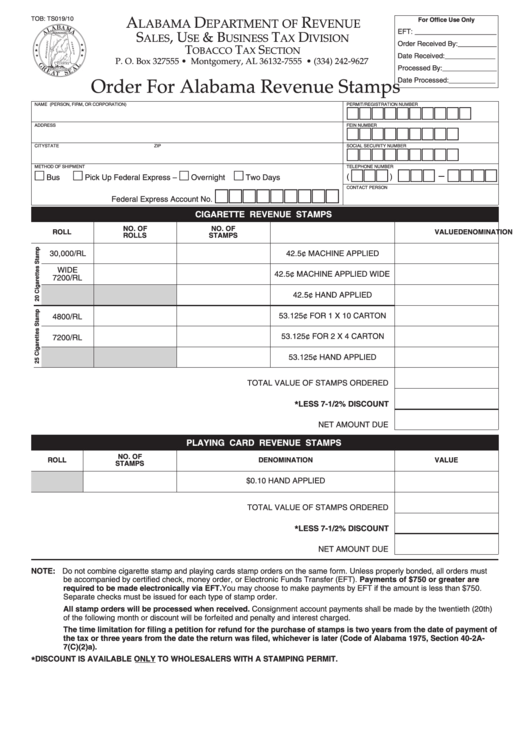

Order For Alabama Revenue Stamps

Reset

NAME (PERSON, FIRM, OR CORPORATION)

PERMIT/REGISTRATION NUMBER

ADDRESS

FEIN NUMBER

CITY

STATE

ZIP

SOCIAL SECURITY NUMBER

METHOD OF SHIPMENT

TELEPHONE NUMBER

–

(

)

Bus

Pick Up

Federal Express –

Overnight

Two Days

CONTACT PERSON

Federal Express Account No.

CIGARETTE REVENUE STAMPS

NO. OF

NO. OF

ROLL

DENOMINATION

VALUE

ROLLS

STAMPS

30,000/RL

0

42.5¢ MACHINE APPLIED

0.00

WIDE

0

42.5¢ MACHINE APPLIED WIDE

0.00

7200/RL

42.5¢ HAND APPLIED

0.00

0

53.125¢ FOR 1 X 10 CARTON

0.00

4800/RL

53.125¢ FOR 2 X 4 CARTON

0.00

0

7200/RL

53.125¢ HAND APPLIED

0.00

0.00

TOTAL VALUE OF STAMPS ORDERED

0.00

*

LESS 7-1/2% DISCOUNT

0.00

NET AMOUNT DUE

PLAYING CARD REVENUE STAMPS

NO. OF

ROLL

DENOMINATION

VALUE

STAMPS

$0.10 HAND APPLIED

TOTAL VALUE OF STAMPS ORDERED

*

LESS 7-1/2% DISCOUNT

NET AMOUNT DUE

NOTE: Do not combine cigarette stamp and playing cards stamp orders on the same form. Unless properly bonded, all orders must

be accompanied by certified check, money order, or Electronic Funds Transfer (EFT). Payments of $750 or greater are

required to be made electronically via EFT. You may choose to make payments by EFT if the amount is less than $750.

Separate checks must be issued for each type of stamp order.

All stamp orders will be processed when received. Consignment account payments shall be made by the twentieth (20th)

of the following month or discount will be forfeited and penalty and interest charged.

The time limitation for filing a petition for refund for the purchase of stamps is two years from the date of payment of

the tax or three years from the date the return was filed, whichever is later (Code of Alabama 1975, Section 40-2A-

7(C)(2)a).

DISCOUNT IS AVAILABLE ONLY TO WHOLESALERS WITH A STAMPING PERMIT.

*

1

1 2

2