Exempt Purchase Certification Form - State Of Rhode Island

ADVERTISEMENT

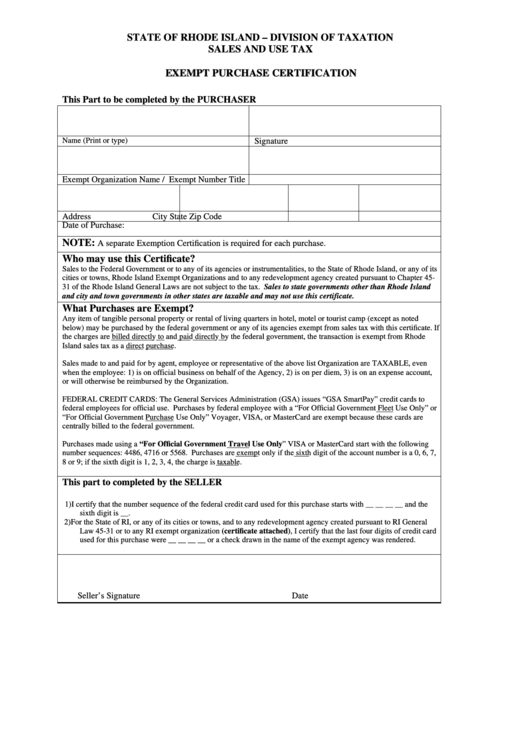

STATE OF RHODE ISLAND – DIVISION OF TAXATION

SALES AND USE TAX

E

X

E

M

P

T

P

U

R

C

H

A

S

E

C

E

R

T

I

F

I

C

A

T

I

O

N

E

X

E

M

P

T

P

U

R

C

H

A

S

E

C

E

R

T

I

F

I

C

A

T

I

O

N

This Part to be completed by the PURCHASER

Name (Print or type)

Signature

Exempt Organization Name / Exempt Number

Title

Address

City

State

Zip Code

Date of Purchase:

NOTE:

A separate Exemption Certification is required for each purchase.

Who may use this Certificate?

Sales to the Federal Government or to any of its agencies or instrumentalities, to the State of Rhode Island, or any of its

cities or towns, Rhode Island Exempt Organizations and to any redevelopment agency created pursuant to Chapter 45-

31 of the Rhode Island General Laws are not subject to the tax. Sales to state governments other than Rhode Island

and city and town governments in other states are taxable and may not use this certificate.

What Purchases are Exempt?

Any item of tangible personal property or rental of living quarters in hotel, motel or tourist camp (except as noted

below) may be purchased by the federal government or any of its agencies exempt from sales tax with this certificate. If

the charges are billed directly to and paid directly by the federal government, the transaction is exempt from Rhode

Island sales tax as a direct purchase.

Sales made to and paid for by agent, employee or representative of the above list Organization are TAXABLE, even

when the employee: 1) is on official business on behalf of the Agency, 2) is on per diem, 3) is on an expense account,

or will otherwise be reimbursed by the Organization.

FEDERAL CREDIT CARDS: The General Services Administration (GSA) issues “GSA SmartPay” credit cards to

federal employees for official use. Purchases by federal employee with a “For Official Government Fleet Use Only” or

“For Official Government Purchase Use Only” Voyager, VISA, or MasterCard are exempt because these cards are

centrally billed to the federal government.

Purchases made using a “For Official Government Travel Use Only” VISA or MasterCard start with the following

number sequences: 4486, 4716 or 5568. Purchases are exempt only if the sixth digit of the account number is a 0, 6, 7,

8 or 9; if the sixth digit is 1, 2, 3, 4, the charge is taxable.

This part to completed by the SELLER

1)

I certify that the number sequence of the federal credit card used for this purchase starts with __ __ __ __ and the

sixth digit is __.

2)

For the State of RI, or any of its cities or towns, and to any redevelopment agency created pursuant to RI General

Law 45-31 or to any RI exempt organization (certificate attached), I certify that the last four digits of credit card

used for this purchase were __ __ __ __ or a check drawn in the name of the exempt agency was rendered.

Seller’s Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1