Excise Tax Report Form - Alcholic Beverage By The Drink

ADVERTISEMENT

City of

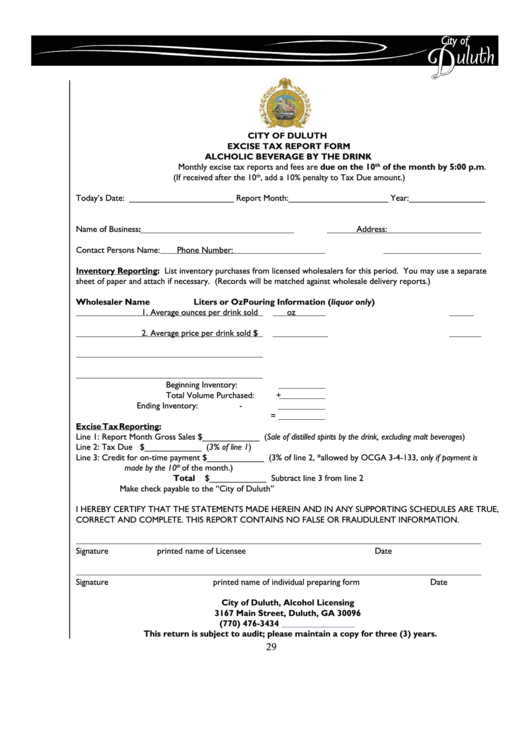

CITY OF DULUTH

EXCISE TAX REPORT FORM

ALCHOLIC BEVERAGE BY THE DRINK

th

Monthly excise tax reports and fees are due on the 10

of the month by 5:00 p.m.

(If received after the 10

th

, add a 10% penalty to Tax Due amount.)

Today’s Date: ______________________ Report Month:_____________________ Year:________________

Name of Business:

Address:

Contact Persons Name:

Phone Number:

Inventory Reporting: List inventory purchases from licensed wholesalers for this period. You may use a separate

sheet of paper and attach if necessary. (Records will be matched against wholesale delivery reports.)

Pouring Information (liquor only)

Wholesaler Name

Liters or Oz

1. Average ounces per drink sold

oz

2. Average price per drink sold $

Beginning Inventory:

Total Volume Purchased:

+

Ending Inventory:

-

=

Excise Tax Reporting:

Line 1: Report Month Gross Sales $____________ (Sale of distilled spirits by the drink, excluding malt beverages)

Line 2: Tax Due

$____________ (3% of line 1)

Line 3: Credit for on-time payment $____________ (3% of line 2, *allowed by OCGA 3-4-133, only if payment is

th

made by the 10

of the month.)

Total

$____________ Subtract line 3 from line 2

Make check payable to the “City of Duluth”

I HEREBY CERTIFY THAT THE STATEMENTS MADE HEREIN AND IN ANY SUPPORTING SCHEDULES ARE TRUE,

CORRECT AND COMPLETE. THIS REPORT CONTAINS NO FALSE OR FRAUDULENT INFORMATION.

Signature

printed name of Licensee

Date

Signature

printed name of individual preparing form

Date

City of Duluth, Alcohol Licensing

3167 Main Street, Duluth, GA 30096

(770) 476-3434

This return is subject to audit; please maintain a copy for three (3) years.

29

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1