Merchants And/or Business Privilege And Occupation Tax Return Form

ADVERTISEMENT

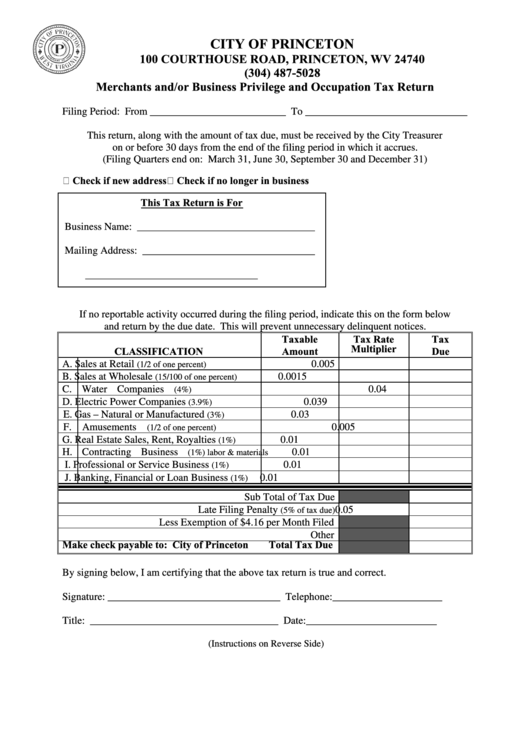

CITY OF PRINCETON

100 COURTHOUSE ROAD, PRINCETON, WV 24740

(304) 487-5028

Merchants and/or Business Privilege and Occupation Tax Return

Filing Period: From __________________________ To _______________________________

This return, along with the amount of tax due, must be received by the City Treasurer

on or before 30 days from the end of the filing period in which it accrues.

(Filing Quarters end on: March 31, June 30, September 30 and December 31)

Check if new address

Check if no longer in business

This Tax Return is For

Business Name: __________________________________

Mailing Address: _________________________________

_________________________________

If no reportable activity occurred during the filing period, indicate this on the form below

and return by the due date. This will prevent unnecessary delinquent notices.

Taxable

Tax Rate

Tax

CLASSIFICATION

Amount

Multiplier

Due

A. Sales at Retail

0.005

(1/2 of one percent)

B. Sales at Wholesale

0.0015

(15/100 of one percent)

C. Water Companies

0.04

(4%)

D. Electric Power Companies

0.039

(3.9%)

E. Gas – Natural or Manufactured

0.03

(3%)

F. Amusements

0.005

(1/2 of one percent)

G. Real Estate Sales, Rent, Royalties

0.01

(1%)

H. Contracting Business

0.01

(1%) labor & materials

I.

Professional or Service Business

0.01

(1%)

J.

Banking, Financial or Loan Business

0.01

(1%)

Sub Total of Tax Due

Late Filing Penalty

0.05

(5% of tax due)

Less Exemption of $4.16 per Month Filed

Other

Make check payable to: City of Princeton

Total Tax Due

By signing below, I am certifying that the above tax return is true and correct.

Signature: _________________________________

Telephone:_____________________

Title: ____________________________________

Date:_________________________

(Instructions on Reverse Side)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1