Clear Form

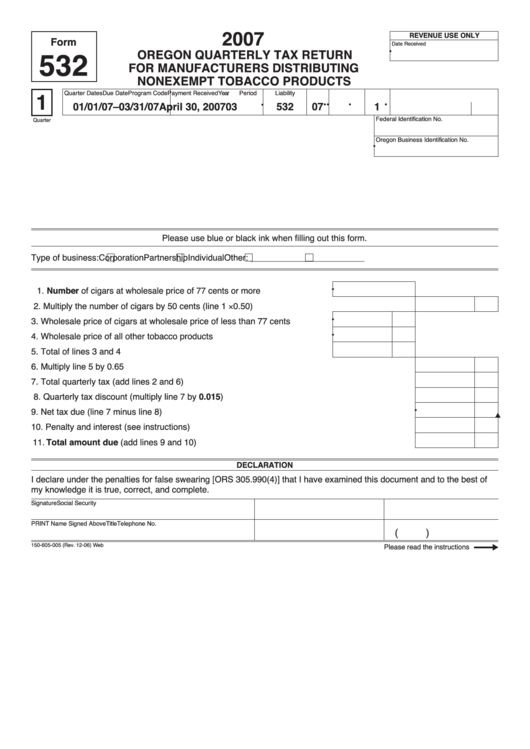

2007

REVENUE USE ONLY

Form

Date Received

•

OREGON QUARTERLY TAX RETURN

532

FOR MANUFACTURERS DISTRIBUTING

NONEXEMPT TOBACCO PRODUCTS

Quarter Dates

Due Date

Program Code

Year

Period

Liability

Payment Received

1

•

•

•

•

•

01/01/07–03/31/07

April 30, 2007

532

07

03

1

Federal Identification No.

Quarter

Oregon Business Identification No.

•

Please use blue or black ink when filling out this form.

Type of business:

Corporation

Partnership

Individual

Other: ________________________

•

1. Number of cigars at wholesale price of 77 cents or more ..........................1

2. Multiply the number of cigars by 50 cents (line 1 × 0.50) ............................................................. 2

•

3. Wholesale price of cigars at wholesale price of less than 77 cents ...........3

•

4. Wholesale price of all other tobacco products ...........................................4

5. Total of lines 3 and 4 ..................................................................................5

6. Multiply line 5 by 0.65 .................................................................................................................. 6

7. Total quarterly tax (add lines 2 and 6) .......................................................................................... 7

8. Quarterly tax discount (multiply line 7 by 0.015) .......................................................................... 8

•

9. Net tax due (line 7 minus line 8) .................................................................................................. 9

10. Penalty and interest (see instructions) ....................................................................................... 10

11. Total amount due (add lines 9 and 10)......................................................................................11

DECLARATION

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document and to the best of

my knowledge it is true, correct, and complete.

Signature

Social Security No.

Date

PRINT Name Signed Above

Title

Telephone No.

(

)

150-605-005 (Rev. 12-06) Web

Please read the instructions

1

1 2

2 3

3 4

4 5

5