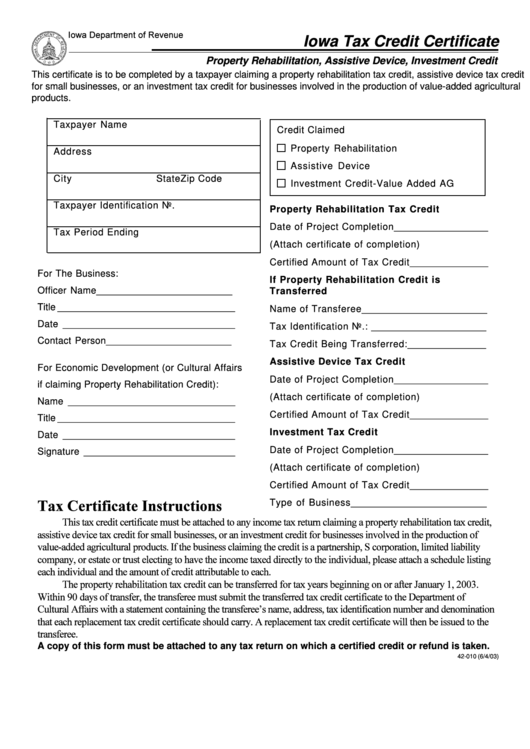

Form 42-010 - Iowa Tax Credit Certificate - Property Rehabilitation, Assistive Device, Investment Credit Form

ADVERTISEMENT

Iowa Department of Revenue

Iowa Tax Credit Certificate

Property Rehabilitation, Assistive Device, Investment Credit

This certificate is to be completed by a taxpayer claiming a property rehabilitation tax credit, assistive device tax credit

for small businesses, or an investment tax credit for businesses involved in the production of value-added agricultural

products.

Taxpayer Name

Credit Claimed

Property Rehabilitation

Address

Assistive Device

City

State

Zip Code

Investment Credit-Value Added AG

Taxpayer Identification No.

Property Rehabilitation Tax Credit

Date of Project Completion __________________

Tax Period Ending

(Attach certificate of completion)

Certified Amount of Tax Credit _______________

For The Business:

If Property Rehabilitation Credit is

Officer Name __________________________

Transferred

Title __________________________________

Name of Transferee ________________________

Date _________________________________

Tax Identification No.: ______________________

Contact Person ________________________

Tax Credit Being Transferred: _______________

Assistive Device Tax Credit

For Economic Development (or Cultural Affairs

Date of Project Completion __________________

if claiming Property Rehabilitation Credit):

(Attach certificate of completion)

Name ________________________________

Certified Amount of Tax Credit _______________

Title __________________________________

Investment Tax Credit

Date _________________________________

Date of Project Completion __________________

Signature _____________________________

(Attach certificate of completion)

Certified Amount of Tax Credit _______________

Tax Certificate Instructions

Type of Business __________________________

This tax credit certificate must be attached to any income tax return claiming a property rehabilitation tax credit,

assistive device tax credit for small businesses, or an investment credit for businesses involved in the production of

value-added agricultural products. If the business claiming the credit is a partnership, S corporation, limited liability

company, or estate or trust electing to have the income taxed directly to the individual, please attach a schedule listing

each individual and the amount of credit attributable to each.

The property rehabilitation tax credit can be transferred for tax years beginning on or after January 1, 2003.

Within 90 days of transfer, the transferee must submit the transferred tax credit certificate to the Department of

Cultural Affairs with a statement containing the transferee’s name, address, tax identification number and denomination

that each replacement tax credit certificate should carry. A replacement tax credit certificate will then be issued to the

transferee.

A copy of this form must be attached to any tax return on which a certified credit or refund is taken.

42-010 (6/4/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1